February 19, 2019/SEC

The Securities and Exchange Commission, SEC, has sealed off the premises of Growing Circle in Lagos for engaging in illegal fund management activities.

According to the Commission, the company was shut down for carrying out investment operations that falls within fund management without registration with the apex regulator.

The commission had established that the company’s activities also constituted an infraction of the Investments and Securities Act (ISA), 2007.

According to SEC, “They do not have registration with the SEC and the Commission has powers according to Section 13 (w) of ISA 2007, to shut down any company carrying out capital market activities without due registration”.

“The mode of operation of the company is that for a new entrant, registration is N10,000 and the person is not entitled to products while the second category has a registration fee of N16,000 that entitles the registrant to receive products.

“for anyone to come under the company, he has to come under an up liner since the company engages in networking business.

For the networking business, the Least stage is a starter point with minimum registration of $50 with an incentive of $15 for a member who introduced two down liners.

It was gathered that the company also engages in free seminars at its head office for people to learn more about the products and the money making business with an unbeatable compensation plan and huge bonuses.

The SEC disclosed that however, after registering, the members claim they do not get any products from the company and all efforts to retrieve their funds proved abortive, hence the complaint to the SEC.

While the company claimed to have a factory in Ogun state, the said factory could not be located even though the products were on display at their Lagos office.

The SEC Management said the closure was to end unlawful activities of the company against unsuspecting investors and therefore urged investors to ensure they only deal with fund managers that are registered with the Commission.

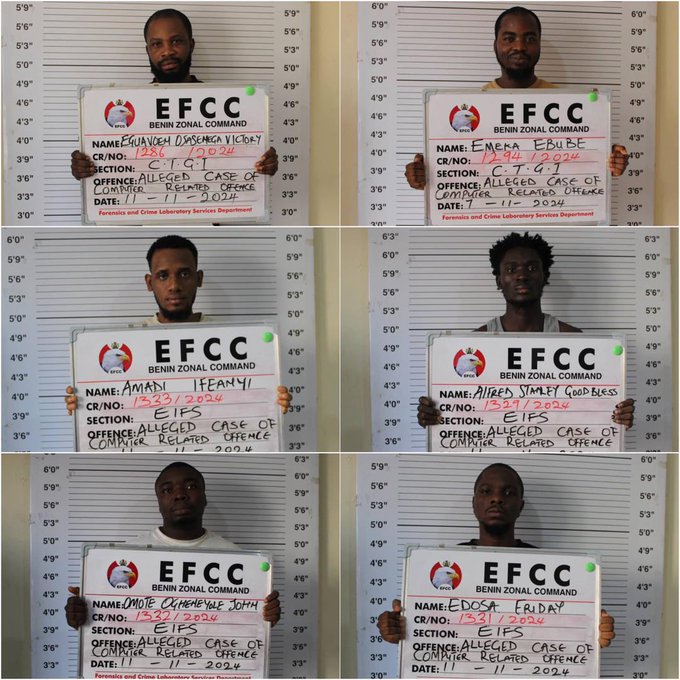

“The accounts of the company have been frozen, the promoters have been arrested by the Nigeria Police Force and are undergoing interrogation.

The Commission wishes to notify the investing public that the company is not licensed to carry out investments business of any type and as such its operations are illegal.

The SEC therefore advises the public to exercise due diligence and caution in the course of making investment decisions adding that valid licence of lawful operators could be obtained on the commission’s website by members of the public to confirm the licences of firms with which they intend to carry out investment activities.