October 4, 2019/Ecobank Nigeria

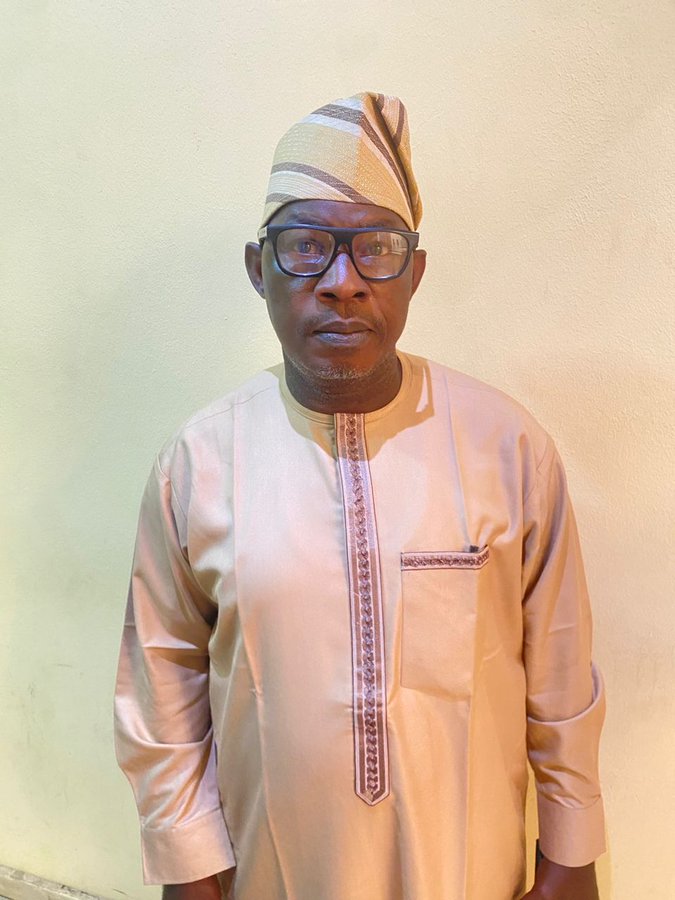

Ecobank Nigeria limited has advocated continuous collaboration by all stakeholders in the fight against cyber crimes in the country. In his welcome address at the second general meeting of Nigeria electronic Fraud Forum (NeFF) in Lagos, Patrick Akinwuntan, Managing Director, Ecobank Nigeria, said the activities of cybercrimes has assumed a high dimension, stressing that all hands must be on the deck to check the menace.

Mr. Akinwuntan who was represented by the Group Head, Operations and Technology, Ecobank, David Isiavwe, saluted the efforts of the Central Bank of Nigeria (CBN), NeFF and other interest groups for coordinating and championing the fight against the crime, assuring them of Ecobank support.

In his words: “We must all salute the courage of the CBN and the NeFF especially in the gallant role that they are playing in coordinating and championing the fight against cybercrime. We at Ecobank duly recognize this role and fully support it as we know the immense benefits that accrue to the society by having a safe and secure environment where banking and general commerce can be done by the citizens of the country,” noting that “it is generally known that the strength of any system is determined by its weakest link. Thus, the need for information sharing and continuous collaboration by all stakeholders is paramount. Again, we must salute the efforts of the CBN for bringing together key stakeholders on a continuous basis to evaluate different aspects of cybersecurity and to further inoculate the system.”

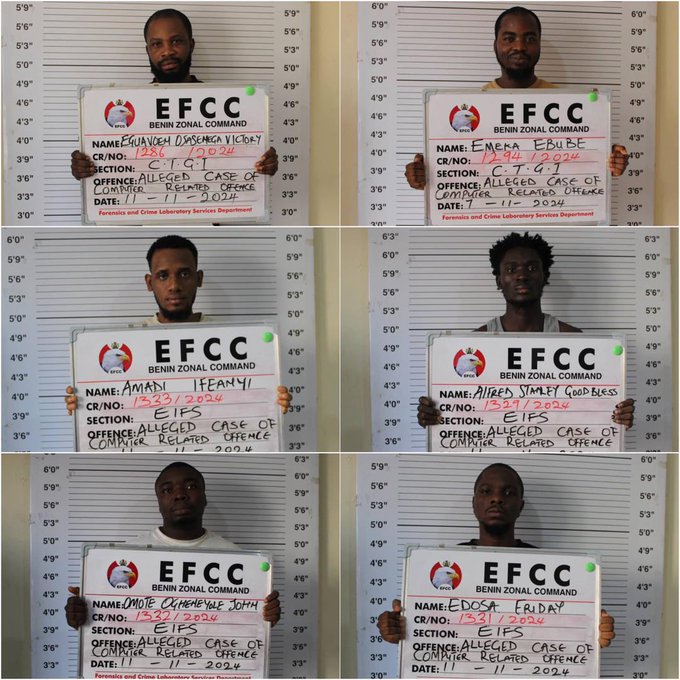

Speaking earlier, the Chairman NeFF, Mr Sam Okejere called for the review of existing, enactment of new laws in a bid to mitigate fraud risks in the payment system in the country. Okojere noted the imperativeness due to the re-introduction of cashless Policy that will increase electronic transactions and electronic fraud. It is necessary to review and strengthen the existing rules and enact new regulations to mitigate fraud risks in the Payment system. As Evidenced by the NIBSS second quarter fraud report of 2019, attempted fraud volume decreased by 47.28 per cent in Q1 figures, while Web, ATM, and Mobile remain the usual suspects to be used by fraudsters”

“Because of the cashless Policy re-introduction and following the trend of increase in usage of electronic transactions that occurred in 2012 against 2018, which has seen growth, there is a likelihood of continued increase in electronic transactions and corresponding potential upsurge in electronic fraud in spite of collective and concerted efforts to check fraud in the country” The Chairman said.