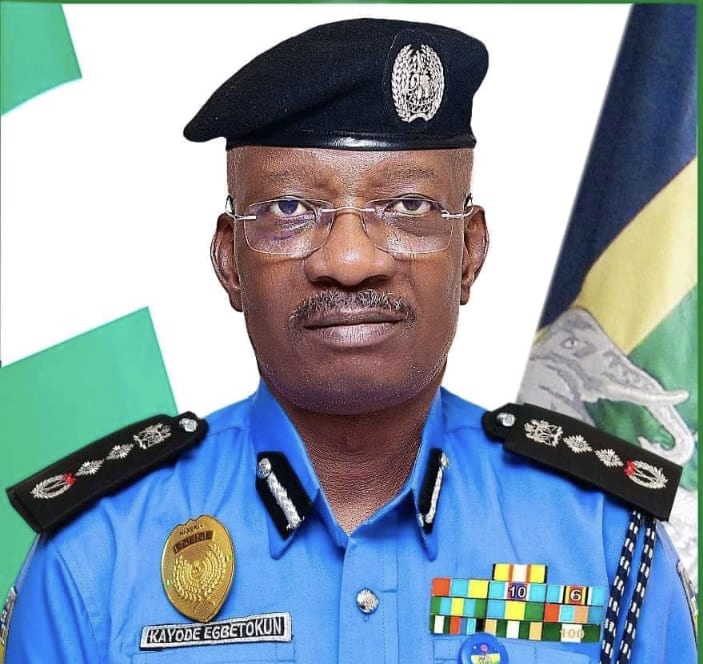

Oscar Onyema, CEO, Nigerian Stock Exchange (NSE)

The Nigerian Stock Exchange (NSE or The Exchange) hosted its annual 2020 Market Recap and 2021 Outlook today, 19 January 2021.

This annual event is a forum for The Exchange to review its performance in the just-concluded year and expert predictions for the Nigerian capital market in 2021. It featured presentations from the Chief Executive Officer, NSE, Mr. Oscar N. Onyema, OON and the Managing Director, Chief Economist, Africa and Middle East, Global Research, Standard Chartered Bank, Ms. Razia Khan, who provided insights into the global macroeconomic environment and the outlook and opportunities in the Nigerian capital market.

Delivering his presentation, Mr. Onyema stated, “The year 2020 was indeed a historic one for global capital markets. Facing buffeting headwinds, world markets saw sharp swings and steep losses, but largely remained resilient and orderly amid rising uncertainty. For The Exchange, renewed investor optimism coupled with improved economic conditions and low fixed income yields, propelled a year end bull run. Of 93 global equity indices tracked by Bloomberg, the NSE All Share Index (ASI) emerged the best-performing index in the world, surpassing the S&P 500 (+16.26%), Dow Jones Industrial Index (+7.25%) and other global and African market indexes, to post a one-year return of +50.03%.”

Key highlights of his presentation are as follows:

Global Capital Market

The outbreak of the novel coronavirus disease (Covid-19) and its rapid spread across the globe in the first quarter of the year triggered panic selling by global investors. According to the World Federation of Exchanges (WFE), global capital markets lost USD 18 trillion due to the pandemic over the course of February and March 2020 alone. However, diverging from grim economic projections, global markets saw a rebound following the sharp drop in March, as many indicators recovered to pre-pandemic levels by June 2020, fuelled by extraordinary stimulus packages, monetary policy actions and public health responses from world governments and economic actors.

Product Performance

The Nigerian equities market got off to a strong start in 2020, returning 10.4% by the eighth trading session. By October, the equities market entered a much awaited bull run. Buoyed by the formal declaration of the U.S president-elect, unattractive fixed income yields and better-than-expected corporate earnings, the NSE ASI recovered from Q1’20, to close the year at 40,270.72 (+50.03%) and erase losses of -14.90% recorded in 2019. During its remarkable year end run, the ASI gained 6.23% in a single trading session which triggered a 30-minute halt of trading on all stocks for the first time since the NSE Circuit Breaker was introduced in 2016 to safeguard market integrity in periods of extraordinary volatility.

At the close of the year, the NSE’s equity market capitalization was up by 62.42%, from N12.97 trillion in 2019 to N21.06 trillion in 2020 while market turnover saw an uptick of 7.25%, from N0.96Tn in 2019 to N1.03Tn in 2020. Although Initial Public Offering activity was mute, the value of supplementary issues increased dramatically from 2019, rising by 851.37% to N1.42 trillion, from N148.77 billion. Also noteworthy is that for the second consecutive year, equity market transactions were dominated by domestic investors who accounted for 65.28% of market turnover by value (Retail: 44.98%; Institutional: 55.02%) while foreign portfolio investors accounted for 34.72%.

Capital-raising activities in the fixed income market increased significantly in 2020. The NSE’s bond market capitalization rose by 35.52% from N12.92 trillion in 2019 to N17.50 trillion. Continuing the trend in recent years, the Federal Government of Nigeria dominated issuances, raising over N2.36 trillion which comprised ~92% of total bond issuances. Corporates also leveraged the low yield environment to fund expansion objectives and pursue debt refinancing, raising a total of N192 billion.

Some of the ground breaking achievements for the year include:

· The historic listing of Interswitch’s N23 billion 15.00% Fixed Rate Series 1 bond. The premier bond listing illustrates the potential of The Exchange to support FinTechs and growth companies across various economic sectors

· The listing of Dangote Cement’s N100 billion 12.50% Series 1 bond under its N300 billion bond programme which became the largest corporate bond issuance in Nigeria’s fixed income market

· Listing of Primero Plc’s first bond on the NSE – the Primero BRT Securitization SPV Plc bond valued at N16.5 billion.

The NSE Exchange Traded Fund (ETF) market experienced its best year yet. Market capitalization increased by 272.30% from N6.58 billion recorded in 2019 to N24.51 billion in 2020 while trade volumes increased by 218.23% from 4.15 million units in 2019 to 13.20 million units in 2020, and turnover skyrocketed by 51,830.59%. These achievements can be attributed to several factors including:

· growing adoption of the asset class by investors and asset managers on the back of strong year on year growth;

· launch of two new ETFs – Meristem Growth ETF and Meristem Value ETF by Meristem Wealth Management Limited which track the NSE Meristem Growth Index and NSE Meristem Value Index respectively; and

· unattractive yields in the fixed income market which led investors to seek alternative asset classes as also experienced in the equity market

The NEWGOLD ETF, which tracks the price of gold and offers investors the opportunity to invest in a listed instrument that is backed by a gold bullion and serves as a good currency hedge, was the best performing ETF for the second year running as it returned 66.03% in 2020, reflecting investors’ continued preference for risk-backed securities.

Strategic Performance of NSE

In terms of the strategic performance of The Exchange, several milestones were recorded in 2020 as follows:

· The NSE moved closer to its goal of launching Exchange Traded Derivatives as NG Clearing Limited received approval in principle from the Securities and Exchanges Commission (SEC) to launch clearing and settlement of exchange-traded derivative products as Nigeria’s premier Central Counterparty Clearing House (CCP).

· Plans for demutualisation also advanced significantly following the Court Ordered Meeting (COM) and Extraordinary General Meeting (EGM) where Members of The Exchange unanimously voted in favour of the resolutions presented for consideration. The Scheme of Arrangement for the NSE’s demutualisation was also sanctioned by the Federal High Court.

· The NSE launched the Growth Board to support SMEs to access the capital market, by offering advisory support, relaxed entry criteria and reduced post-listing obligations. Four (4) companies – McNichols Consolidated Plc, The Initiates Plc, Living Trust Mortgage Bank Plc and Chellarams Plc., were successfully migrated to the Growth Board.

· Building on its digital credentials, The Exchange revamped the NSE Data Portal to facilitate easier access to NSE market data; upgraded the X-Issuer platform to further enhance market integrity and X-Whistle to strengthen investor protection; launched the X-PO to boost retail participation in the market and automate listing processes; and released.

Market Initiatives

The Exchange sustained its thought leadership and advocacy role in the capital market evidenced by the:

· Successful transition of stakeholder engagement activities to virtual sessions including the Oil and Gas webinar, Sustainable Capital Markets forum, Smart Investing Workshop, 5th Market Data Workshops, 2nd NSE CEO’s Stakeholder Engagement Call, Nigerian Securities Lending Forum and 2nd Islamic Finance Forum.

· Review and amendment of the Pension Index to ensure that it represents the appropriate benchmark for evaluating Pension Fund Administrators’ equity portfolios.

· Revision of its trading fee charge on debt instruments to 0.0005% (N5 per million) to boost liquidity in the fixed income market.

· Accreditation of X-Academy by the Chartered Institute of Bankers, Nigeria (CIBN). The academy also partnered with the Institute of Chartered Secretaries and Administrators of Nigeria (ICSAN) and the IoD Centre of Corporate Governance (IoDCCG) to run Corporate Governance trainings in view of the pandemic.

· Compensation of a total of N17.02 million to 49 investors/claimants who suffered pecuniary losses in 2020. The NSE also facilitated restitutions and recoveries of shares worth N305.11 million for investors in 2020.

Corporate Citizenship Development

In upholding its key pillars of sustainability, The NSE:

· Joined the fight against COVID-19 in Nigeria by committing a total of N100. N60 million was donated to Capital Market Support Committee for COVID-19 (CMSCC), while N40 million was donated to the NSE’s “Masks for All Nigerians” campaign which saw the distribution of face masks to low-income households.

· Hosted a half day symposium which ended with the closing bell to commemorate International Women’s Day (IWD) and gender equality.

· Published the first and second editions of StockTown, a comic book aimed at promoting financial literacy in Nigeria.

· Won the Best Regulatory Information Management award from the Lagos Public Relations Industry Gala and Awards (LaPRIGA Awards).

Outlook for 2021

Looking ahead, Onyema said, “The year has started on a positive note as the ASI has already returned 2.0% after 11 trading sessions. We expect the marginal reopening of businesses, normalization of the economy and revenue-diversification drive of the Nigerian government to elicit positive sentiments throughout the year. Our growth expectations should be noted with caution, as the recent second wave of COVID-19 in Nigeria and globally, may slow down renewed social and economic activities.”

As the NSE transitions to a demutualised exchange group, the appointments of Mr. Temi Popoola as the CEO of NGX and Ms. Tinuade Awe as CEO of NGX REGCO were recently announced. The NSE believes that these appointments will support its vision to be “Africa’s preferred Exchange Hub” and looks forward to consolidating on the benefits of demutualization in the coming year. The Exchange also reiterated its intention to aggressively pursue cutting-edge products and services, access new markets and deliver better value to its stakeholders.