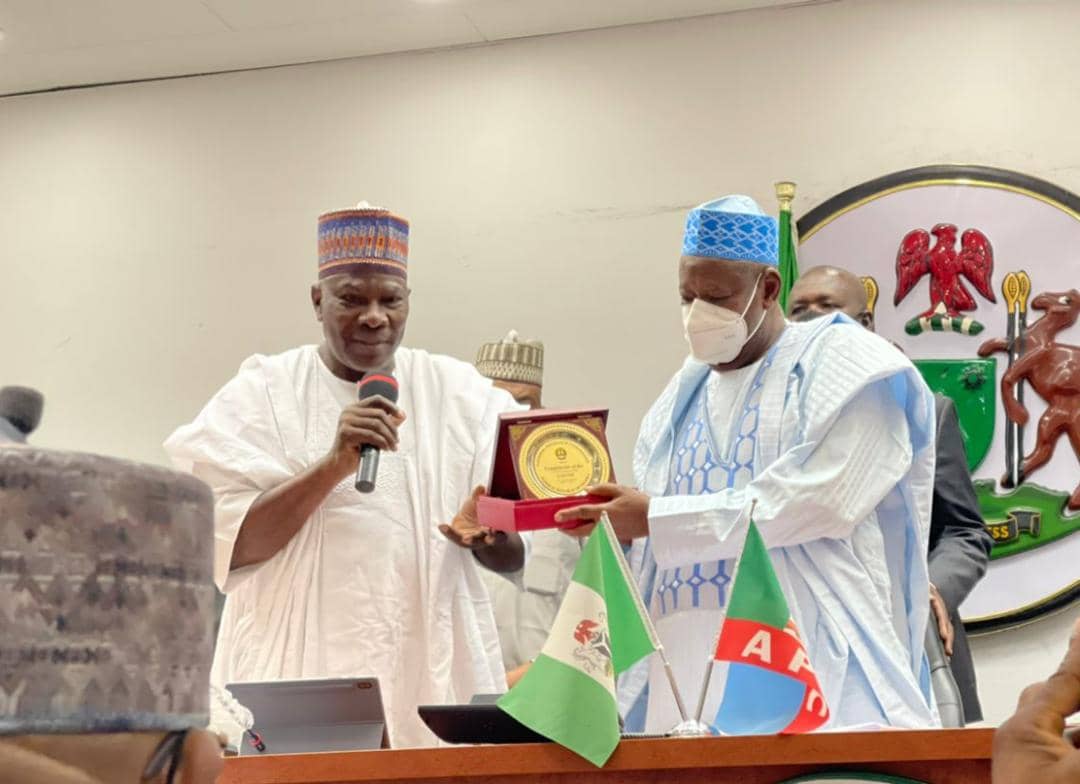

L-R: Commissioner for Insurance Sunday Thomas and Executive Governor of Kano State Dr. Abdullahi Umar Ganduje during a courtesy visit by National Insurance Commission to the Governor in Kano State today

BY NKECHI NAECHE-ESEZOBOR–The Governor of Kano State, Alh. Abdullahi Umar Ganduje, has pledged to work with the National Insurance Commission (NAICOM) on implementation and enforcement of compulsory insurance as well as working with the legislative arm on domesticating the insurance laws in the State

The Governor stated this today during a courtesy visit by the management of NAICOM led by the Commissioner for Insurance, Sunday Thomas, to his office in Kano, State.

Ganduje commended the commission on its effort to develop the insurance sector while urging the industry to do more in gaining public confidence and improving public perception of the industry.

Earlier, the Commissioner for Insurance used the occasion to seek collaboration with the State government in the enforcement of compulsory insurances in the State.

He noted that the commission is incepting talks with stakeholders to ensure that enforcement commence in earnest of all classes of compulsory insurances across the country.

He however requested the support of the governor to constitute a committee that will work with the commission, consider mirroring the legislation that makes it mandatory for citizens to have compulsory insurances and

to provide the commission with a befitting office accomodation that will serve as the insurance policy hub for the Northern Region of the country.

He assured that the commission is committed to continually ensure and guaranty adequate protection of policyholders.

This effort he said has been taken in many fronts such as ensuring that genuine claims are promptly paid by insurers, ensuring financial soundness and viability of the insurers to protect investments, right prizing of insurance products, value for money, use of technology for ease of transaction etc.

He also appealed to the governor to partner insurance industry to bring all vehicles in the state under insurance cover, so as to boost its Internally Generated Revenue (IGR) and revenue of all stakeholders.

Thomas noted that one of the cardinal thrust that has been a forefront policy of the federal government is financial inclusion, which is assisting nano, micro, small and medium enterprises for a sustainable economic development and lifting families out of abject poverty.