BY NKECHI NAECHE-ESEZOBOR–Vehicles with genuine insurance policies captured on the Nigeria Insurance Industry Database (NIID) are about to 3.4 million as at February 2022, the Chairman, Nigerian Insurers Association (NIA), Ganiyu Musa has said.

Musa added that 200,000 policies has also been uploaded in the marine module in same period.

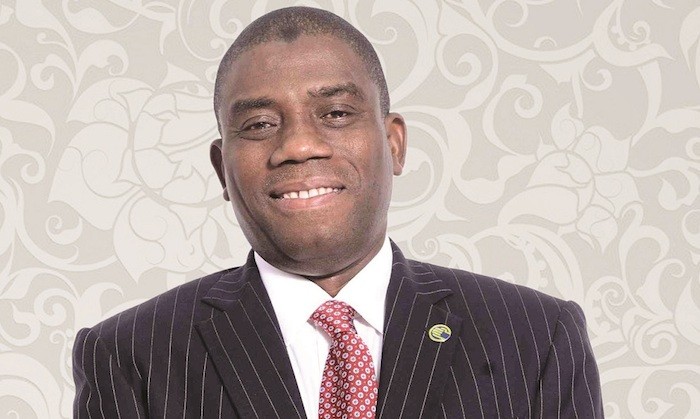

He disclosed this today at a media to highlight the industry achievements in 2021 and expectations in 2022, adding that the NIID has really impacted positively on the operations of insurance companies.

Musa who also doubles as the group managing director of Cornerstone insurance Plc, noted that though the number of vehicles captured falls below expectations following the covid-19 pandemic restrictions which resulted to lack of international trade.

He however assured that things are beginning to pick up gradually from last quarter of 2021.

The NIID solution is designed to help Insurers and NIA monitor and authenticate all insurance policies issued in Nigeria toward reducing the incidence of fraudulent transactions and the loss of business by the insurance companies. The motor vehicle insurance policy module is the first part of the project that has commenced while other insurance cover types are expected to commence before the end of the year.

On the Consolidated Insurance Bill 2020, he said is still receiving legislative attention in the National Assembly and the Association is on top of developments on it.

“We are optimistic that the Bill will be passed into law before long.

“We are happy to note that the Finance Act 2021 has been signed into law and this has resolved a major issue with regards to the definition of the components of minimum capital.”

He noted that the Association is engaging the National Insurance Commission (NAICOM) with a view to determining the next steps.

On marker development, the NIA Boss assured that the Association will continue to complement the efforts of NAICOM in their campaign on domestication of compulsory insurances in the States .

“It is our expectation that laws on compulsory insurance can be domesticated in other States just as Lagos State has done.”