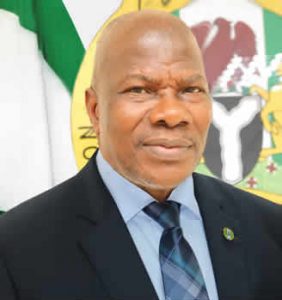

Commissioner for Insurance, Mr. Sunday Olorundare Thomas

BY NKECHI NAECHE-ESEZOBOR— The Nigerian insurance industry must take it rightful position in the financial sector, it must begin to change the narrative and embracing transparency, engagement of all stakeholders, better innovative products, new sources of revenue, improved claims service, use of technology for inclusive insurance, diversification of business base and improved governance.

These were the words of the Commissioner for Insurance, Mr. Olorundare Thomas, at the just concluded 2022 retreat organised by the Nigerian Council of Registered Insurance Brokers (NCRIB) for Chief Executive Officers of the insurance broking firms in Lagos.

According to him “the impact of unsustainable trends can create significant pressures on the industry’s profitability in the short and long run. They include: inadequate brokerage services to policyholders, poor claims handling service, price based competition among players, lack of innovative products that meet customer’s needs, concentration of operations in few locations, focus on big ticket businesses, as well as poor distribution channels and skills.”

“As CEOs, you need to be mindful of the need to entrench a sound “Business Strategy for Sustainability” as many insurance businesse claims, but without a realistic and effective sustainable business strategy. Suffice it to say that such businesses are unlikely to deliver the gains that more sustainable performance could bring through the determination of their activities, behaviour, products, services and a detailed understanding of the environmental and social context in which they operate,” he noted.

“You will agree with me that the imperative for a sound personal mastery and self-leadership cannot be over-emphasised as companies globally are under pressure from multiple stakeholders to adopt sustainable business practices in which the insurance broking arm is not an exception.”

“As an arm of the insurance sector, your collective resolve to ensure business sustainability and collective growth and development with other arms of the industry will determine how far we can all go in achieving industry wide stability.”

He restated that the commission is committed to continuous development and growth of the Nigerian insurance sector thus, always prepared to collaborate with all stakeholders in promoting and entrenching good business strategies for sustainability of the Nigerian Insurance Industry.

He listed reaching out to the states and agencies of government; enhancing of it’s Technology; infrastructure, bringing the Nigerian insurance industry into the mainstream of continental and on its way to global relevance as some of it’s initiatives to improve the industry.

He commended the president and members of council for not just putting this retreat together but in the choice of theme and speakers.