BY NKECHI NAECHE- ESEZOBOR–KBL Insurance Limited is stepping up efforts by drawing the attention of members of the public to road safety and regulatory compliance with relevant insurance laws and regulations.

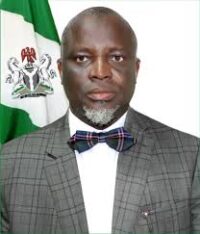

Speaking in that regards, Managing Director/CEO of the company, Lawal Mijinyawa, emphasized the Company’s commitment to customer convenience and regulatory compliance.

He called on the general public to comply with the regulation, detailing the importance of Motor Insurance.

Assuring its customers he said “At KBL Insurance we believe insurance is more than just policies. It is about protecting lives, securing assets, and ensuring peace of mind. Our goal is to simplify Third-Party Motor Insurance so that every vehicle owner in Nigeria remains compliant with the law while benefiting from seamless insurance coverage and top-tier customer support.”

The Third-Party Motor Insurance is mandatory for all vehicle owners, as it is now enforced by the Nigeria Police Force and the National Insurance Commission (NAICOM). The policy provides financial protection by covering liabilities for damages or injuries caused to third parties in the event of accident.

Despite its legal requirement, many motorists are unaware of the serious risks of driving without valid insurance. A defaulter could pay a fine of N250,000, which may include impounding the vehicle along other strict sanctions.

The exercise has since begun in Lagos, Akwa Ibom, and Edo States, where the Police announced the full implementation. This is in compliance with the directive of the National Insurance Commission (NAICOM) in conjunction with the Nigerian Police Force.

KBL Insurance Limited is committed to bridging this gap through increased awareness activities, radio jingles, market storms, seminars, and an improved service experience.

To make insurance more accessible, faster, and stress-free, KBL Insurance Limited has upgraded its digital platforms and customer support services. Customers can now conveniently subscribe or renew their policies from the comfort of their homes through an easy-to-use online portal,

The insurer has also strengthened its nationwide customer support team, to provide real-time assistance, ensuring that policyholders receive seamless service.

Additionally, the claims process has been optimized for speed, transparency, and minimal turn-around time, allowing customers to get payouts without delays.With affordable premiums starting at just ₦15,000 per year, Third-Party Motor Insurance provides crucial protection while ensuring compliance with the law. The policy covers damages to other vehicles, third-party property, and bodily injuries caused by the insured vehicle.

By maintaining valid coverage, motorists can avoid unnecessary legal troubles and financial burdens while enjoying peace of mind on the road