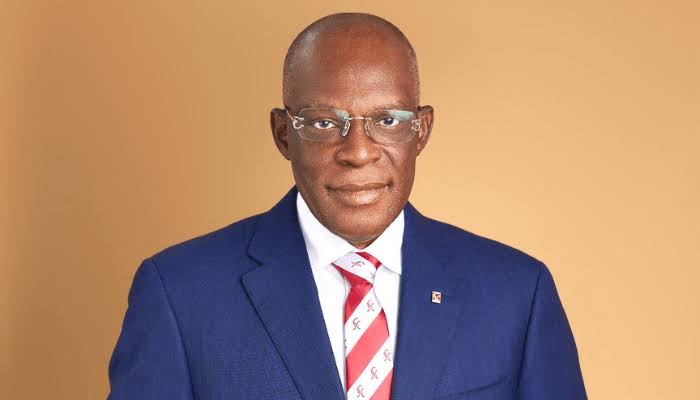

BY NKECHI NAECHE-ESEZOBOR—Group Chief Executive Officer of Consolidated Hallmark Holdings Plc and Chairman of CHI Life Assurance Limited, Mr. Eddie Efekoha, has described the launch of CHI Life Assurance Limited as the fulfillment of a long-term vision to offer Nigerians a full spectrum of financial protection — spanning general insurance, health services, finance, and now life assurance.

He disclosed this in Lagos during the official unveiling of CHI Life Assurance Limited, the newest member of the Consolidated Hallmark Group.

He recalled that during Nigeria’s insurance consolidation exercise between 2005 and 2007, the Group had to exit the life assurance business to focus on building a strong general insurance franchise.

He recalled that during Nigeria’s insurance consolidation exercise between 2005 and 2007, the Group had to exit the life assurance business to focus on building a strong general insurance franchise.

“Eighteen years ago, we stepped away from life assurance to focus on strengthening our general insurance operations. Today, we have come full circle — returning stronger and more diversified,” he said.

The establishment of Consolidated Hallmark Holdings Plc as a non-operating holding company in 2024 paved the way for the creation of CHI Life, joining Consolidated Hallmark Insurance Limited, Hallmark Health Services Limited, and Hallmark Finance Company Limited under one umbrella.

Leveraging Technology to Deepen Insurance Penetration

Efekoha emphasized that life assurance remains a critical growth frontier for Nigeria’s insurance industry, where penetration still lags behind leading African markets.

He pledged that CHI Life would leverage technology to simplify processes, enhance accessibility, and design innovative products that meet the needs of individuals, families, cooperatives, and businesses.

“We will continue to create flexible, investment-linked life policies that safeguard savings and support wealth creation, even in today’s challenging economic climate,” he added.

On recapitalisation he said “I am pleased to confirm that CHI Life and CHI General have already exceeded the minimum capital requirements of ₦10 billion and ₦15 billion, respectively, as at September 2025.”

He applauded the leadership of National Insurance Commission (NAICOM)’, led by Mr. Olusegun Ayo Omosehin, the Commissioner for Insurance, for his reform-driven leadership at NAICOM, noting significant strides in market regulation, policyholder protection, and industry confidence.