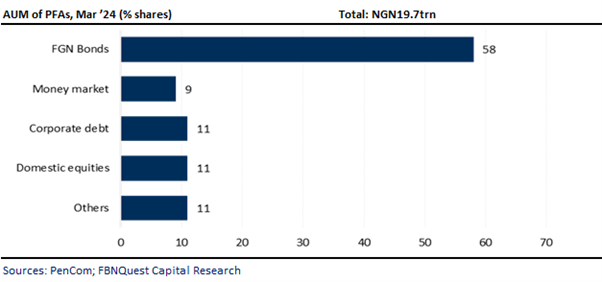

According to the most recent data from the National Pension Commission (PenCom), the regulated pension industry’s total assets under management (AUM) decreased mildly by N90.3bn to N19.7trn in Mar ’24.

The reduction in March marks an end to the consecutive monthly growth in pension assets that started in Oct ’22. In standardised terms, the overall pension assets only make up about 8.6% of Nigeria’s 2023 GDP, reflecting the underpenetrated level of the pension industry.

Nigeria’s pension assets to GDP ratio compares unfavourably with the global average, which stands at 29.4% (in 2020) based on World Bank data.

- The FGN Bonds drove the m/m reduction in pension assets, whose value decreased by -NGN284.4bn or (-2% m/m) to NGN11.5trn. As a result, its share of total AUM fell by -117bps m/m to 58.3%.

- If we include treasury bills, sukuk bonds and other agency bonds, the FGN securities share of total AUM decreased slightly to around 62.0%, down from 62.6% in the previous month.

- Corporate debt securities, whose value of pension holdings declined by -N230.9bn m/m to N2.1trn in March, was another contributor to the m/m decline in the industry’s pension assets.

- Conversely, the value of pension AUM held in domestic equities increased by N166.6bn or (+9% m/m) to about NGN2.1trn, taking its share to c.10.6% from 9.7% in February.

- Going forward, we anticipate reducing PFA’s allocation to equities due to the equity market’s weak performance in recent weeks.

- The Nigerian stock exchange (NGX) declined by -6% m/m in April, primarily due to the rotation out of stocks into fixed-income securities because of attractive yields.

- The decline was also contributed to by the negative investor reaction to the CBN’s announcement of the banks’ recapitalisation plans.

- Notably, the latest PenCom data show 10.3 million scheme memberships. This implies an average NGN1.91m per RSA account holder, higher than the NGN1.57m in the year-earlier period.

Source FBNQuest Research