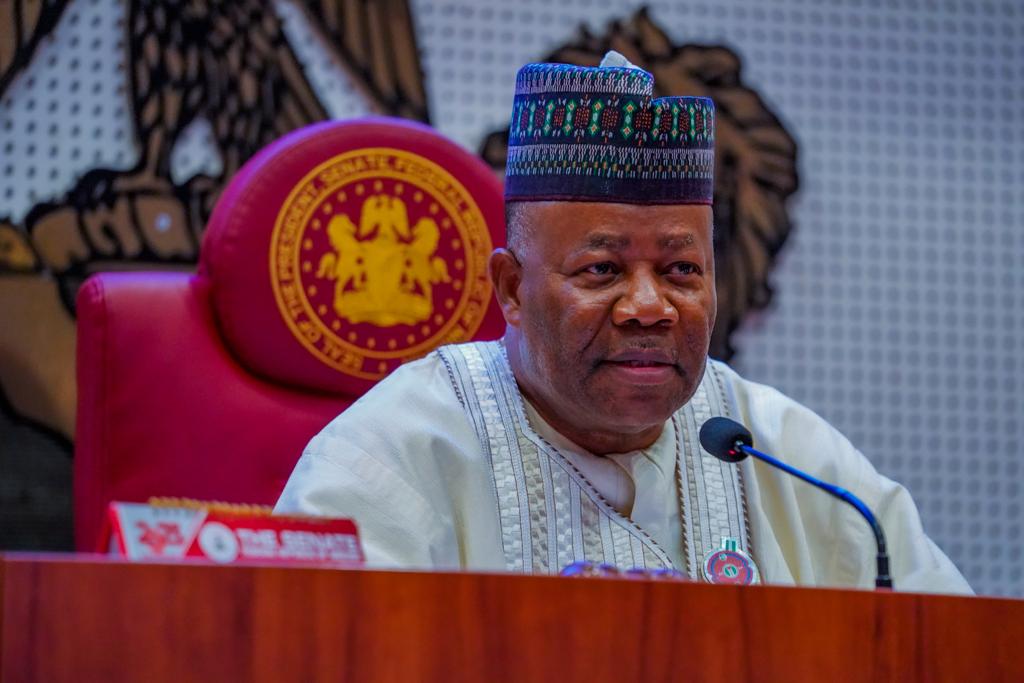

Nnamdi Okonkwo, chief Executive Officer, Fidelity Bank Plc

August 13, 2018/Fidelity Bank Plc

Fidelity Bank Plc, top Nigerian lender in strategic partnership with the Bank of Industry (BoI) has launched the Aba Finished Leather Goods Cluster Financing Programme, as part of continuous efforts to promote Made-in-Nigeria goods capable of meeting global standards for export and local consumption. N400 million in financing provided by BoI will be made available on a quarterly basis to over 300 members of the Leather Products Manufacturers Association of Abia State (LEPMAAS). The funds will be disbursed through the Fidelity Bank while the Ford Foundation would provide technical support to the artisans.

Speaking at the formal launch of the initiative in Aba on Wednesday, the Bank’s Chief Executive Officer, Nnamdi Okonkwo, said the partnership with BoI further underlines the Bank’s staunch commitment to addressing the financing challenges confronting Micro Small Medium Enterprises (MSMEs) in Nigeria. Whilst stating that the financing scheme will further boost import substitution, Okonkwo who was represented by the Bank’s Head, Corporate Bank, Obaro Odeghe, pointed out that the loans will enable them procure requisite materials and equipment for production and expansion.

Under this scheme, Obaro said the Bank will provide short-term loans with maximum obligor limits of N300,000 to N500,000 to qualified members of LEPMAAS. According to him, the partnership with BoI is in furtherance of the financial institution’s commitment towards building the next generation of international entrepreneurs in the art of leather products manufacturing in the cluster. “Our long-running support for the growth and development of MSMEs stems from the utmost recognition of their strategic importance, as critical agents of economic development and transformation in Nigeria.

“Under the scheme, we will also provide tailored capacity building support to members of LEPMAAS”, Okonkwo explained. To enhance the governance activities of the LEPMAAS Executives and support BoI’s planned monitoring of loans under the programme, Fidelity Bank donated an ultra-modern and fully equipped secretariat for LEPMAAS.

Obaro urged beneficiaries of the financing scheme to ensure that loans are repaid to drive sustainability of the financing programme. Speaking in the same vein, Managing Director of BoI, Olukayode Pitan, noted that the programme was designed to provide a tailored bundle of financial and non-financial services including capacity building to qualified members of LEPMAAS.

Pitan explained that finished leather products to which LEPMAAS is a major contributor, accounts for over 80 percent of the textile apparel and footwear component of the manufacturing sector. According to him, informal computations put yearly revenue from the cluster at over N10 billion despite the competing volumes of similar goods being imported.

“By providing low interest, non-collaterised loans, the Bank has provided flexibility for qualified members of LEPMAAS recommended by their line and zonal chairmen to access up to N300,000 towards the procurement of materials to expand and improve their production activities.

“The programme is being implemented alongside Ford Foundation and Fidelity Bank Plc. The Foundation will be providing a grant that specifically focuses on strengthening the capacities of the leaders and beneficiaries even as monitoring structures to ensure loan repayments are instituted. Fidelity Bank will provide account management services to the loan beneficiaries.”

Ford Foundation Regional Director, Innocent Chukwuma, said the partnership with BoI was part of efforts to fulfil its commitment to leather manufacturers to encourage local production and increase campaign for adoption of made-in-Aba. To this end, Chukwuma said the Foundation would be staking a grant of $150,000 in the programme to drive social impact and enhance productivity.

In African Retail Banking

Fidelity Bank, BOI, Ford Foundation Unveils Lending Scheme For Aba Leather Manufacturers

Posted by InvestAdvocate on August 13, 2018 in Money Market | 0 Comments

• Lender Donates Fully Equipped Secretariat To LEPMAAS

Nnamdi Okonkwo, chief Executive Officer, Fidelity Bank Plc

August 13, 2018/Fidelity Bank Plc

Fidelity Bank Plc, top Nigerian lender in strategic partnership with the Bank of Industry (BoI) has launched the Aba Finished Leather Goods Cluster Financing Programme, as part of continuous efforts to promote Made-in-Nigeria goods capable of meeting global standards for export and local consumption. N400 million in financing provided by BoI will be made available on a quarterly basis to over 300 members of the Leather Products Manufacturers Association of Abia State (LEPMAAS). The funds will be disbursed through the Fidelity Bank while the Ford Foundation would provide technical support to the artisans.

Speaking at the formal launch of the initiative in Aba on Wednesday, the Bank’s Chief Executive Officer, Nnamdi Okonkwo, said the partnership with BoI further underlines the Bank’s staunch commitment to addressing the financing challenges confronting Micro Small Medium Enterprises (MSMEs) in Nigeria. Whilst stating that the financing scheme will further boost import substitution, Okonkwo who was represented by the Bank’s Head, Corporate Bank, Obaro Odeghe, pointed out that the loans will enable them procure requisite materials and equipment for production and expansion.

Under this scheme, Obaro said the Bank will provide short-term loans with maximum obligor limits of N300,000 to N500,000 to qualified members of LEPMAAS. According to him, the partnership with BoI is in furtherance of the financial institution’s commitment towards building the next generation of international entrepreneurs in the art of leather products manufacturing in the cluster. “Our long-running support for the growth and development of MSMEs stems from the utmost recognition of their strategic importance, as critical agents of economic development and transformation in Nigeria.

“Under the scheme, we will also provide tailored capacity building support to members of LEPMAAS”, Okonkwo explained. To enhance the governance activities of the LEPMAAS Executives and support BoI’s planned monitoring of loans under the programme, Fidelity Bank donated an ultra-modern and fully equipped secretariat for LEPMAAS.

Obaro urged beneficiaries of the financing scheme to ensure that loans are repaid to drive sustainability of the financing programme. Speaking in the same vein, Managing Director of BoI, Olukayode Pitan, noted that the programme was designed to provide a tailored bundle of financial and non-financial services including capacity building to qualified members of LEPMAAS.

Pitan explained that finished leather products to which LEPMAAS is a major contributor, accounts for over 80 percent of the textile apparel and footwear component of the manufacturing sector. According to him, informal computations put yearly revenue from the cluster at over N10 billion despite the competing volumes of similar goods being imported.

“By providing low interest, non-collaterised loans, the Bank has provided flexibility for qualified members of LEPMAAS recommended by their line and zonal chairmen to access up to N300,000 towards the procurement of materials to expand and improve their production activities.

“The programme is being implemented alongside Ford Foundation and Fidelity Bank Plc. The Foundation will be providing a grant that specifically focuses on strengthening the capacities of the leaders and beneficiaries even as monitoring structures to ensure loan repayments are instituted. Fidelity Bank will provide account management services to the loan beneficiaries.”

Ford Foundation Regional Director, Innocent Chukwuma, said the partnership with BoI was part of efforts to fulfil its commitment to leather manufacturers to encourage local production and increase campaign for adoption of made-in-Aba. To this end, Chukwuma said the Foundation would be staking a grant of $150,000 in the programme to drive social impact and enhance productivity.