Fitch Ratings has placed Union Bank of Nigeria PLC’s (UBN) Issuer Default Ratings (IDRs), Viability Rating (VR) and National Ratings on Rating Watch Negative (RWN). A full list of rating actions is below.

UBN’s Government Support Rating of ‘no support’ is not affected by this rating action.

Key Rating Drivers

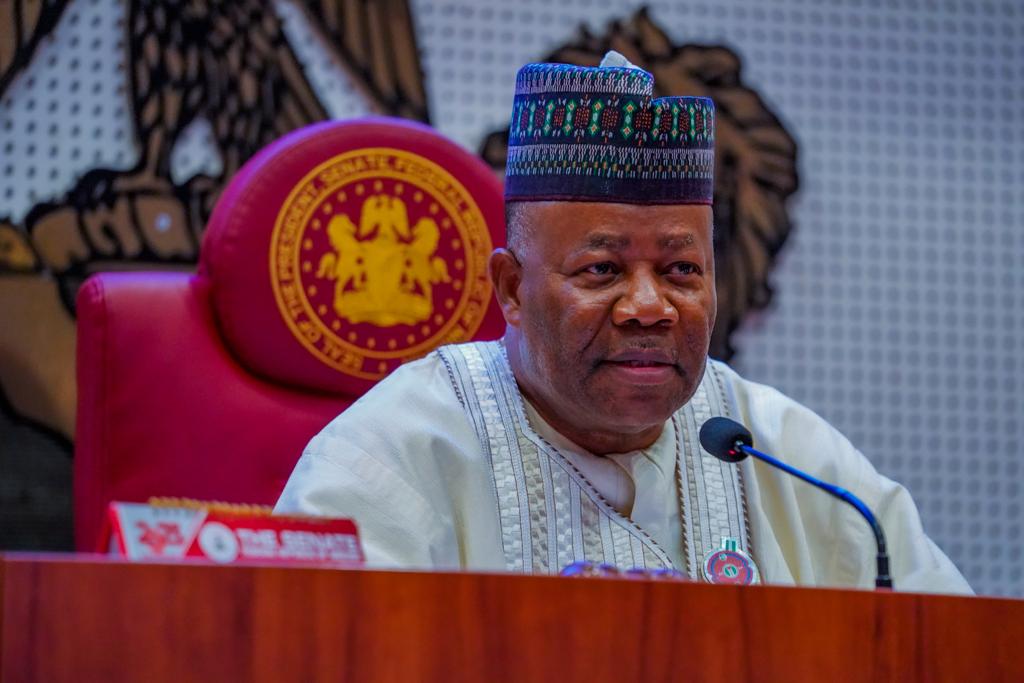

The RWN follows the Central Bank of Nigeria’s (CBN) announcement on 10 January that it had dissolved the board and management of three Nigerian banks, including UBN, as a result of regulatory non-compliance, corporate governance failure, disregarding the conditions under which banking licenses were granted and involvement in activities that pose a threat to financial stability, among other infractions. The CBN has since appointed new executives, including chief executive officers, to oversee the affairs of the banks.

The RWN reflects the uncertainty surrounding the background to the CBN’s intervention, the potential for further regulatory actions and the negative implications for UBN’s standalone credit profile, particularly relating to corporate governance risks and liquidity pressures arising from potential funding instability. Fitch expects to resolve the RWN within six months once there is more certainty regarding the CBN’s intervention and the implications for UBN’s standalone credit profile.

Rating Sensitivities

Factors that Could, Individually or Collectively, Lead to Negative Rating Action/Downgrade

A downgrade (and potential resolution of the RWN) could result from further regulatory intervention, e.g. imposition of restrictive measures on UBN’s activities, fines or other regulatory findings (such as weaker asset quality than initially reported by UBN), that would lead to large losses and erosion of the bank’s capital. The downgrade could also result from UBN’s funding instability, i.e. due to a deposit run or where additional liquidity sources become unavailable to the bank.

Read Also: Breaking: CBN Dissolves Board And Management Of Union Bank, Keystone Bank And Polaris Bank

For additional downside sensitivities see the most recent rating action commentary published on 8 September 2023: Fitch Affirms Union Bank of Nigeria PLC at ‘B-‘; Outlook Stable.

Factors that Could, Individually or Collectively, Lead to Positive Rating Action/Upgrade

The ratings could be affirmed and removed from RWN if UBN continues to operate as normal under the new management in the medium term and there are no additional regulatory interventions or financial profile implications from the management replacement.

REFERENCES FOR SUBSTANTIALLY MATERIAL SOURCE CITED AS KEY DRIVER OF RATING

The principal sources of information used in the analysis are described in the Applicable Criteria.

ESG Considerations

UBN’s ESG Relevance Score for Governance Structure was revised to ‘4’ from ‘3’ due to the dissolution of the board and management by the CBN. This has a negative impact on the credit profile, and is relevant to the ratings in conjunction with other factors.

The highest level of ESG credit relevance is a score of ‘3’, unless otherwise disclosed in this section. A score of ‘3’means ESG issues are credit neutral or have only a minimal credit impact on the entity, either due to their nature or the way in which they are being managed by the entity. Fitch’s ESG Relevance Scores are not inputs in the rating process; they are an observation on the relevance and materiality of ESG factors in the rating decision.