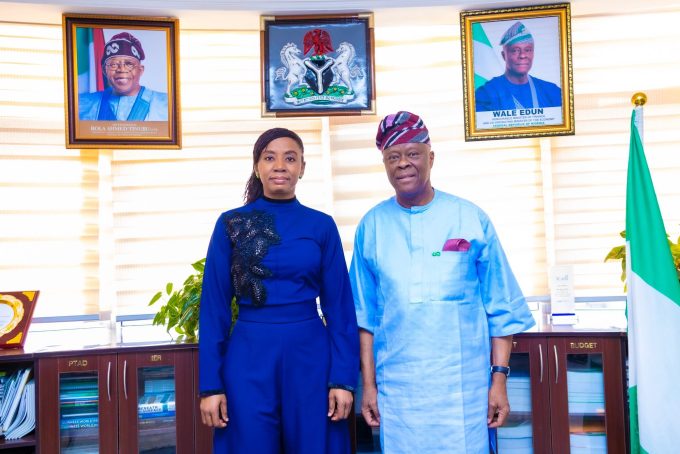

Ms. Omolola Oloworaran, the director-general of the National Pension Commission(Pencom), on Thursday announced that that monthly pension payments rose to N14.837 billion in June 2025, under its Pension Boost 1.0 initiative.

Oloworaran made the disclosure in Abuja at a Stakeholders’ Conference jointly convened by PenCom and the National Salaries, Incomes and Wages Commission (NSIWC), focusing on the “Workings of the Contributory Pension Scheme (CPS).”

The PenCom boss highlighted that the Commission’s Pension Boost 1.0 is enhancing pensions for over 241,000 retirees, representing 80% of those under Programmed Withdrawal.

“Monthly pensions rose from N12.157 billion to N14.837 billion, effective June 2025,” she added.

Oloworaran, represented by PenCom Acting Commissioner, Technical, Hon. Hafiz Kawu Ibrahim, said that more than 10 million Nigerians—from public service employees to private sector workers, and even artisans and the self-employed under the Personal Pension Plan—are covered under the CPS.

Ibrahim added that while pension assets have grown to over N25 trillion, fueling national development through strategic investments, the Commission is securing regular monthly pensions for over 552,000 retirees and lump sum benefits for an additional 291,735 retirees.

“In total, more than 844,000 retirees across both public and private sectors now enjoy retirement benefits that are steady, reliable, and transparent,” the official added.

According to him, the minimum capital and governance requirements for Pension Fund Administrators (PFAs) and Custodians have been revised to ensure greater financial stability, service delivery, and technological resilience.

Ibrahim listed the five new regulations under the Pension Revolution 2.0 initiative to include Whistle Blowing Guidelines for Pension Fund Assets, Revised Regulation on Investment of Pension Fund Assets, Framework for Accredited Pension Agents under the Personal Pension Plan, Guidelines for the Personal Pension Plan, Circular on Revised Minimum Capital Requirements for PFAs and PFCs, and Introduction of Free Health Insurance for Retirees.

However, Ibrahim admitted that challenges remain, citing limited coverage expansion and the fact that several states and employers have yet to fully comply with the pension scheme.

“Public skepticism, often shaped by painful experiences of the past, continues to undermine trust in the system,” the official said.

She announced that PenCom will also embark on nationwide sensitization workshops across all six geopolitical zones—ensuring that every federal employee and pensioner fully understands the CPS and can access its benefits.

She promised that PenCom will diversify pension asset investments to improve returns, strengthen governance and oversight, while expanding coverage to millions more Nigerians, particularly in the informal sector.

ALSO READ:PenCom DG, NUP President Bond To Improve Welfare Of Pensioners

The Chairman of the NSIWC, Ekpo U. O. Nta, Esq., advised stakeholders and authorities to note that proper administration and management of pension that have a direct link to the productivity and stability of any organization.

On his part, the Chairman, Nigerian Union of Pensioners, Comrade Sylva Nwaiwu, appealed that policies and development making the CPS unpopular should be reviewed by the authorities, just as he also called for the political will to ensure impartial implementation of the CPS.