November 30, 2019/AMCON

A legal consultant and Senior Partner, Olaniwun Ajayi -LP, Mr Muyiwa Balogun has challenged Asset Management Corporation of Nigeria (AMCON) and Judges of the Federal High Court of Nigeria (FHC) to leverage the 2019 Amended AMCON Act and declare AMCON obligors who are holding public office bankrupt.

The new 2019 Amended AMCON Act, which was signed into law by President Muhammadu Buhari earlier in the year provided AMCON with sweeping powers, which is intended to help AMCON recover a huge debt of over N5.4trillion owed the corporation by obligors as a result of AMCON intervention in the banking sector. AMCON was created in 2010 as a result of the global economic crises of 2008/2009, which nearly cripples the financial sector of Nigeria.

Without AMCON’s intervention at the time, depositors would have lost N3.7trillion and over 15,000 jobs would have also been lost. Recall that AMCON had purchased approximately 12, 743 loans from the banks through debt instruments worth N3.9trillion with the simple understanding of recovery either through voluntary payment or disposal of assets of the obligors. The government at the time had thought a strong law could as a matter of fact guarantee that, hence the enactment of the AMCON Act in 2010.

But now that recovery is proving herculean to AMCON and have become a source of pain to the Federal Government, Balogun, who reviewed the new AMCON Act 2019 at a one day Seminar for Honourable Judges of the FHC in Abuja at the weekend argued that the only alternative to the recovery challenge was for the judges of the FHC to take the matter as a national assignment and explore all the powers of the new amendment.

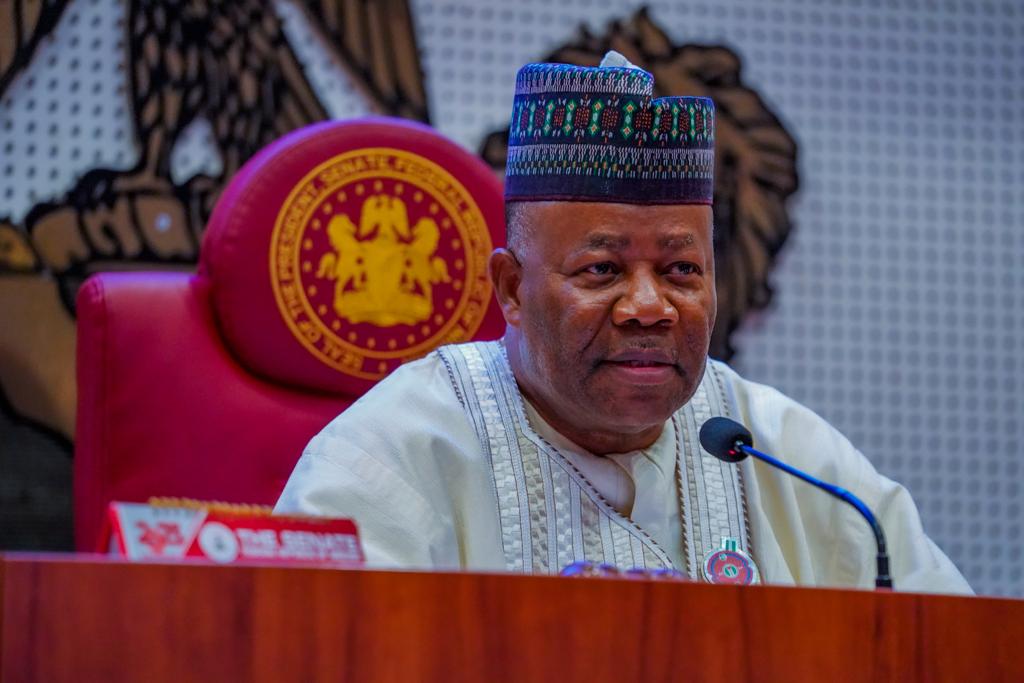

In attendance at the seminar were the Acting Chief Judge of the Federal High Court, Hon. Justice John Terhemba Tsoho, officials of the National Judicial Institute (NJI), the management of AMCON and officials of Legal Academy. Balogun said the Judges of the FHC, which incidentally is AMCON’s court of first instance should as a matter of fact support the corporation to explore the bankruptcy proceedings as provided by the amendment, which he said will at least make it possible for AMCON to rubbish its debtors that are holding public office as persons of no integrity and so cannot hold such office.

According to him, “Once you are declared bankrupt, you cannot hold public office. Today, we have AMCON debtors making laws for the Federal Republic of Nigeria. AMCON with your support, needs to go to court and declare such individuals bankrupt. Given the sunset period of AMCON and the fact that the debt we are talking about is the commonwealth of Nigeria, it would not be out of place to take the full advantage of the bankruptcy power among other special powers in the new amendment.”

The concerned lawyer who stated that the bankruptcy proceedings have been explored in other climes to address similar matters argued that there was no reason why it should not work in Nigeria. Again, he said, “As a way of being proactive with the new amendment of the AMCON Act, let us test the bankruptcy proceedings because it will be effective. In other jurisdictions, this has proved to be a very potent tool and why not in Nigeria,” he wondered.

Balogun further painted a gloomy picture of what could further befall the already challenged Nigerian economy, if the debts were not recovered in good time before the sunset period. He said if the Federal High Court Judges and indeed the judiciary do not support AMCON, the debt profile of the corporation can easily rise to a whopping N6.6trillion by 2024 since AMCON still owed the Central Bank of Nigeria (CBN) N4.5trillion just as it is still battling with N1.7trillion of Assets Under Litigation (AUL).

The debt burden, he explained, will eventually become the burden of the federal government and by extension taxpayers, which is why he said there was need for speed from the angle of the courts. He said it was immoral to allow the obligors go away without punishment especially since both the Holy Bible and the Quran, which incidentally are the dominant religions in the country abhor people who borrow without the intention to pay back.

Balogun added, “The Bible in the book of Psalm 37:21 said, “The wicked borrow and do not repay.” In Proverbs 22:27, the Bible also said, “If you have no money to pay, even your bed will be taken from under you…” The Quran on the other hand in Surat Al-Baqarah: 280 – 282 said, “Whoever borrows money and he intends not to repay it off is a thief.” Backed by these, he stated that there are no legitimate means adopted by AMCON and its agents to recover the debt as mandated by the Amended AMCON Act that can be termed as draconian.

Along the same line of thought, AMCON Managing Director/Chief Executive Officer, Mr. Ahmed Kuru, said even though obligors of AMCON have been working hard to stretch AMCON to the sunset period, the corporation, under his leadership is determined to achieve its mandate within the limited time available (and within the law). The amendment, he stated can only be as effective as the judiciary pronounces on its provisions within the interpretative powers vested by the Constitution of the Federal Republic of Nigeria 1999.

“On our part, we will continue to sensitise our external solicitors on the best approaches in presenting AMCON cases to the courts. During our recent interaction with our external solicitors we conveyed some of our concerns and implored them to properly equip themselves with the unique provisions of the amended AMCON Act as well as the Practice Directions whenever they appear before Your Lordships. AMCON is committed to achieve its mandate within the limited time available (and within the law) and we recognize the crucial role of the judiciary in this effort.

“We have repeatedly made the point at every opportunity that all stakeholders must view the AMCON mandate as one of serious national importance. If at sunset AMCON is unable to recover the huge debt of over N5trillion, it becomes the debt of the Federal Government of Nigeria for which taxpayers’ monies will be used to settle. The implication is that the general public will be made to pay for the recklessness of only a few individuals who continue to take advantage of the loopholes in our laws to escape their moral and legal obligations to repay their debts. We should not allow a few individuals to escape with our commonwealth.

“And we want to do it within the confines of the law. As we all know, the Federal High Court is AMCON’s court of first instance. Under the new amendment, State High Courts and the High Court of the FCT have also been vested with jurisdiction to hear AMCON matters, but the powers to grant ex parte orders under section 49 and 50 of the amended AMCON Act still reside exclusively with the Federal High Court,” Kuru submitted.

He further re-echoed the fact the it was unfortunate that AMCON through the instrumentality of the courts have continued to encounter a lot of challenges, which makes recovery difficult. In addition to that, Kuru said the obligors of AMCON are getting wiser by the day, deliberately causing orchestrated legal delays knowing that AMCON has a sunset date.

It would be recalled that the AMCON Act was first amended in 2015 to address some of the encountered challenges of the corporation at the time. When the obligors again got wiser as it were, it became necessary that the Act be amended again in 2019 with a single objective of recovering the loans bought from the banks in order to settle AMCON’s debt without recourse to taxpayer’s money.