BY NKECHI NAECHE-ESEZOBOR—The Federal Republic of Nigeria through the Debt Management Office, (DMIO), has successfully priced US$2.35 billion in Eurobonds maturing in 2036 (Long 10-year) and 2046 (Long 20-year) in the international capital markets, with

US$ 1.25 billion and US$ 1.10 billion placed in the 2036 and 2046 maturities, respectively.

The Long 10-year bond and the Long 20-year Notes were priced at Coupons / Yields of 8.6308 per cent and 9.1297 per cent, respectively.

Nigeria is pleased to have attracted a wide range of investors from multiple jurisdictions including the United Kingdom, North America, Europe, Asia, Middle East and participation from Nigerian investors, which it views as an expression of continued investor confidence in the country’s sound macro-economic policy

framework and prudent fiscal and monetary management.

The transaction attracted a peak orderbook of over US$13 billion, marking the largest ever orderbook achieved by the Republic. This significant milestone underscores the strong support for the transaction across geography and investor class. With respect to investor class, demand came from a combination of Fund

Managers, Insurance and Pension Funds, Hedge Funds, Banks and other Financial Institutions.

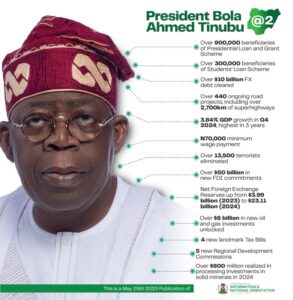

In his remarks on the Transaction, His Excellency, President Bola Ahmed Tinubu, said “We are delighted by the strong investor confidence demonstrated in our country and our reform agenda. This development reaffirms Nigeria’s position as a recognised and credible participant in the global capital market.”

According to the Honourable Minister of Finance and Co-ordinating Minister of the Economy, Mr. Wale Edun, “This successful market access demonstrates the international community’s continued confidence in Nigeria’s reform trajectory and our commitment tosustainable, inclusive growth.”

Patience Oniha, Director-General of the Debt Management Office (DMO), stated that: “Nigeria’s ability to access the Eurobond Market to raise long term funding needed to support the growth agenda of President Bola Ahmed Tinubu is a major achievement for Nigeria and is consistent with the DMO’s objectives of supporting development and diversifying funding sources.”

The Notes will be admitted to the official list of the UK Listing Authority and available to trade on the London Stock Exchange’s regulated market, the FMDQ Securities Exchange Limited and the Nigerian Exchange Limited.

The proceeds from this Eurobond issuance will be used to finance the 2025 fiscal deficit and support the government’s other financing needs.

Nigeria mandated Chapel Hill Denham, Citigroup, Goldman Sachs, J.P. Morgan and

Standard Chartered Bank as Joint Bookrunners. FSDH Merchant Bank Limited acted as Financial Adviser on the issuance.