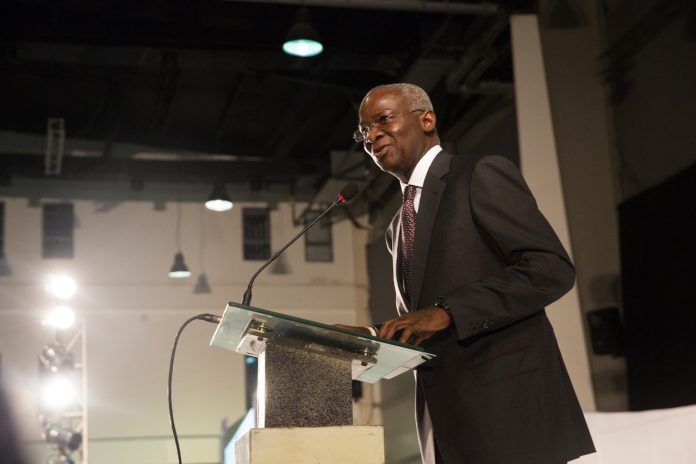

Minister of Power, Works and Housing, Mr Babatunde Fashola, on Friday, urged investors not to panic over the negative trend being experienced in the Nigerian Stock Exchange (NSE).

Speaking at the NSE-London Stock Exchange (LSE) Dual Listing conference in Lagos, Fashola said investors should be calm because the nation’s economic fundamentals remained strong.

He said the bearish run in the market was due profit taking embarked upon by some investors due to the uncertainties surrounding the upcoming elections.

Fashola said people were not sure who would win the election, noting that the development in the market was not unusual.

“The operators in the market know better than to press the panic button, because the fundamentals of the economy are still strong and what is happening in the capital market is normal.

“The Nigerian economy responds to politics like many economies and anyone who knows how the affairs of the world is run, will expect this as some of the people taking profit are preparing to fund the election.

“The best time to buy is when the market is depressed and the best time to sell is when the market is high,” Fashola said.

He said the efforts of the present administration so far had driven the country out of decades of poor economic decisions.

“Our key sectors have improved steadily irrespective of the fact that we are living on 40-50 years infrastructure and we have not stopped yet, even as population has grown in manifold.

“If oil remains our largest export, about two-third of our income source and only 10 per cent of our GDP, it means that we must re-think that economic model and try to do something about it.

“These are the seeds of ailment that affected Nigeria and led us into recession,” he said.

The Minister pointed out that between 2016 and 2017 when the problems set in, the present administration increased capital expenditure.

He said this was by spending on roads, rail and airports through the budget, but at a time when Nigeria was earning less from oil.

According to him, the right prescriptions are being applied to the economy, as there is increased commitment to agriculture and mining as well as better fiscal and revenue controls from taxes.

Fashola said the results have been a recovery from recession so much so that the critical indices of the economy are heading in the right direction.

“It seems to me that the crisis is largely under control and what happens next is a matter of choice we as a people make and that choice, given the regime of very credible election, will be a choice that will be made by you and I.

“A choice whether we want to start again or whether we want to keep this momentum going, a momentum that is arguably going in the right direction,” he said.

Fashola, however, called on the private sector to work with the government to ensure the delivery of amenities that would drive development and employment.

Dr. Doyin Salami, Senior Fellow, Lagos Business School, Pan Atlantic University, said the domestic economy remained in the recovery mode.

Salami said the economic outlook would be driven by oil price, outcome of the 2019 elections and economic policies.

He attributed the bearish trend in the stock market to sell off by foreign portfolio investors due to the forthcoming elections.

Salami said the foreign portfolio investors would slow down their participation in the market.

He noted that Nigeria was known for credible and transparent elections, and that the 2019 election would not be an exception.

The theme of the conference is, “Attracting global capital to drive Nigeria’s economic reforms and sustainable growth development.”

- Home

- Business

- News

- Tourism / Travels

- Entertainment

- Regulators

- More

- Businesstoday Conference/Awards

- Business Today Magazine

Latest News

Please Subscribe

subribe to get the latest news delivered to you free

Capital

BusinessTodayNGJune 2, 20182 Mins read92

BusinessTodayNGJune 2, 20182 Mins read92

Don’t panic over bearish trend in equities market-Fashola tells investors

Share

Related Articles

CSCS Unveils Regconnect Version 2: Revolutionising Data Exchange For Registras

CSCS Unveils Regconnect Version 2: Revolutionising Data Exchange For Registras CSCS UNVEILS...

ByBusinessTodayNGFebruary 18, 2025FCMB Group Lists 19.8bn Shares On NGX After Oversubscribed Public Offer

FCMB Group Plc has listed 19.8 billion shares on the Nigerian Exchange...

ByBusinessTodayNGFebruary 4, 2025H2: Oando Announces 45% Growth In Revenue To N4.1Trillion

Oando PLC, Africa’s leading integrated energy company, has announced a strong financial...

ByBusinessTodayNGFebruary 1, 2025NGX Group Hosts Katsina State Governor, Strengthens Collaboration On Capital Market Opportunities

Nigerian Exchange Group (NGX Group) hosted the Executive Governor of Katsina State,...

ByBusinessTodayNGJanuary 30, 2025