September 9, 2019/Coronation Report

The National Insurance Commission (NAICOM) has announced sweeping reforms, to be implemented by June 2020 – something we term “Insurance reform 2020”.

In this report, we analyse what Insurance Reform 2020 could mean for Nigeria’s insurance industry.

This is as big as banking reform in 2004

Insurance Reform 2020 is very similar to Banking Reform 2004 under CBN Governor Prof. Charles Soludo. Governor Soludo required steep capital increases from the banks, just as NAICOM is doing now.

Why the insurance industry?

Today Nigerian insurance customers are serviced by an under-capitalised and fragmented industry, offering a narrow range of products. In fact, when Coronation Research measured the inflation-adjusted change in industry-wide Gross Premiums over 10 years between 2008-2018, it found there had been no growth at all. And there was minimal growth in US dollar terms over the same period. For this reason we talk about the Nigerian insurance stuck in stagnant Lagoon, but with the prospect of an Ocean beyond.

Doesn’t Nigeria need to get richer first?

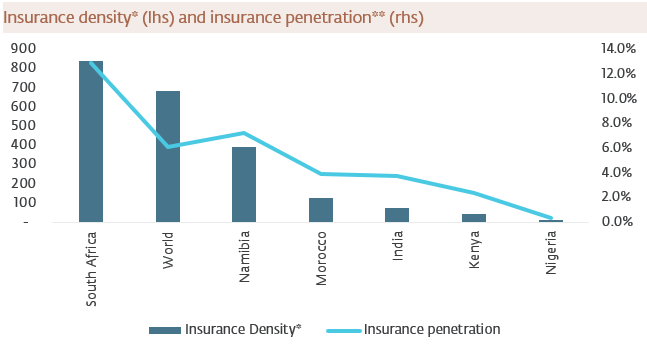

The answer is ‘No’. This is the key finding of the Coronation Research report. Countries with the same GDP per capita have much higher insurance penetration rates (total Gross Premiums divided by GDP) than Nigeria. India, for example, has an insurance penetration rate of 3.69%, compared with Nigeria with 0.31%. This is the real opportunity – potential 10-fold expansion over eight to 10 years.

Today we publish on Nigeria’s diverse insurance industry in the light of moves by its regulator to raise minimum capital requirements steeply. Comparisons with 2004’s banking reform come to mind.

Click here to read full PDF copy of report