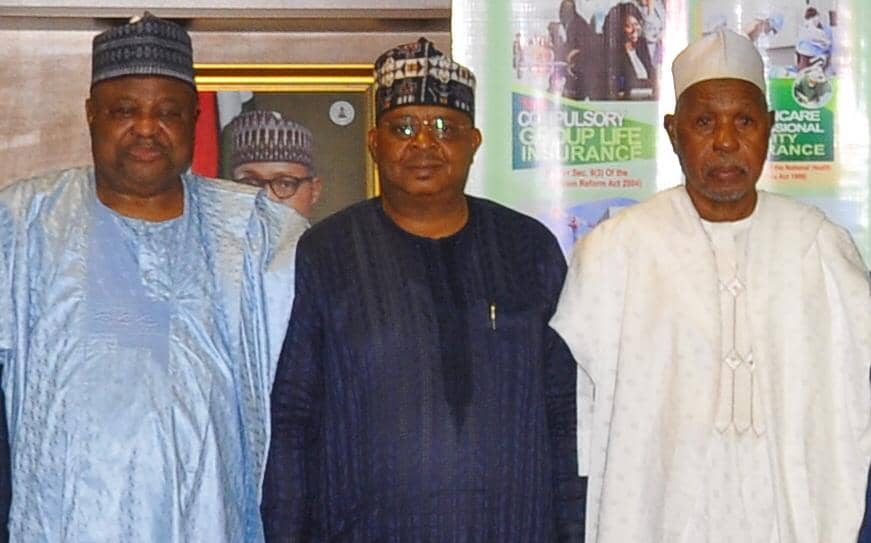

From left: Mannir Yakubu, Deputy Governor of Katsina State; Naicom’s Head Corporate Communication and Market Development, Mr AbdulRasaaq Salami and The Executive Governor of Katsina State HE Aminu Bello Masari at the event.

BY NKECHI NAECHE-ESEZOBOR–In a bid to deepen insurance penetration and awareness in the State, Katsina State government has inaugurated a technical committee to sensitize and implement compulsory insurances and Takaful in the state.

The Committee is to be chaired by the Hon. Commissioner for Commerce in the State Alh. Muktar Gidado Abdulkadir and the co-chairman is the Executive Chairman, Katsina State Internal revenue service Mal. Mustapha Mohammed Sirajo. Other members of the Committee are representatives of the NAICOM, Office of the SSG, Office of the Head of Service in the State, Ministry of Finance, Ministry of Health and other relevant agencies.

The Executive Governor while inaugurating the Technical Committee states that the initiative to introduce Takaful insurance is a welcome development that will serve as an alternative especially to attract people of the state who are left out due to religious or cultural barriers.

He assured the NAICOM of Katsina State Government’s full support in the development of insurance in the State.

In his remakes, the commissioner for insurance, Mr. Sunday Thomas, urged the state government to ensure adequate insurance of its assets and liabilities; liaise with Takaful/insurance operators to determine product best suited for the government, farmers, private companies, MSMEs and individuals in the state.

He noted that the workshop was to pave way for the enforcement and implementation of third-party motor insurance in respect of all mechanically propelled vehicles that ply the public roads; all buildings under construction that are more than two floors; all public buildings including schools, offices, hotels; professional indemnity for all medical practitioners and hospitals; and group life insurance cover by employers for employees where there are more than three persons.

The commissioner who was able represented by the Director, Corporate Communications and Market Development at the Commission, Mr. Abdulrasaaq Abdulsalami, said: “Full implementation of compulsory insurances will help the government cushion the effect of recurring fire inferno in different markets across the state which has been causing so much economic havoc on our traders and the government.

“One of the cardinal objectives of insurance is to protect people against such natural disasters. Abdulsalami said people cannot in some cases, stop it from happening “but we can pre-empt and minimise its impact.”

“Having the markets and goods insured will ensure stability and comfort for the people and also save the government some cost that ordinarily would have gone into compensating traders,” he added.

He added that the commission is also seeking to partner on enforcement of compulsory insurances in the state.

He stated that having Takaful insurance as an alternative to conventional insurance makes it more beneficial that whatever you contribute is not lost at the end of the year.

The commission has licenced four Takaful insurance companies to operate in Nigeria.