BY NKECHI NAECHE-ESEZOBOR-– Insurance regulator, the National Insurance Commission (NAICOM), has called on board of directors of insurance companies to do their possible best to ensure their companies are improving & complying with professional standards.

Besides, it also tasked the directors to take deliberate steps on investment strategies, leveraging technologies; insuring people with disability and improving their Corporate Social Responsibilities (CSR), among others.

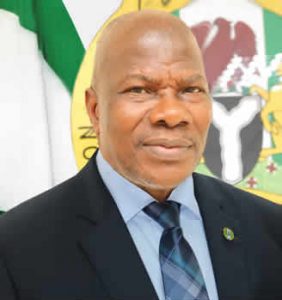

Sunday Thomas, acting commissioner for Insurance, NAICOM, gave the advice during a day Insurance Director’s Conference held in Lagos, with the theme: “Transforming the Insurance industry Through ESG Principles: Directors’ Roles”, noted that the commission has already evolved certain initiatives in risk management and underwriting, product and service development, claims management and sales and marketing.

“We are working with other stakeholders to raise awareness on environmental, social and governance issues, manage risk and develop solutions in the conduct of insurance business in Nigeria.

“We are working together with government at all levels, regulators and other key stakeholders to promote widespread action across society on environmental, social and governance issues in the insurance sector.”

On the theme of the conference he said” It was couched in view of the fact that the world is going through rapid changes economically, socially, and environmentally and, the need to bring Directors of insurance entities to speed on these developments to enable sustainability

“The role of board of directors in the survival and transformation of their establishments can never be over emphasized thus, this Annual programme is meant to apprise the directors with the developments in the industry and also equip them with necessary knowledge that will enhance the value of their companies

“Consequently, for businesses to continually develop, they must take into consideration the community in which they operate, ensure consistent value to customers, maintain the highest standards of governance and ethics, and mitigate its overall impact on the environment.”

He charged the directors to pay serious attention to Environmental, Social and Governance (ESG) principles as they pilot the affairs of their companies in the volatile business environment.

He said the insurance industry globally is continuously undergoing profound changes, and the disruption faced are not just digital but also harsh market conditions, informed demanding customers, innovative/ new market entrants as well as regulations.