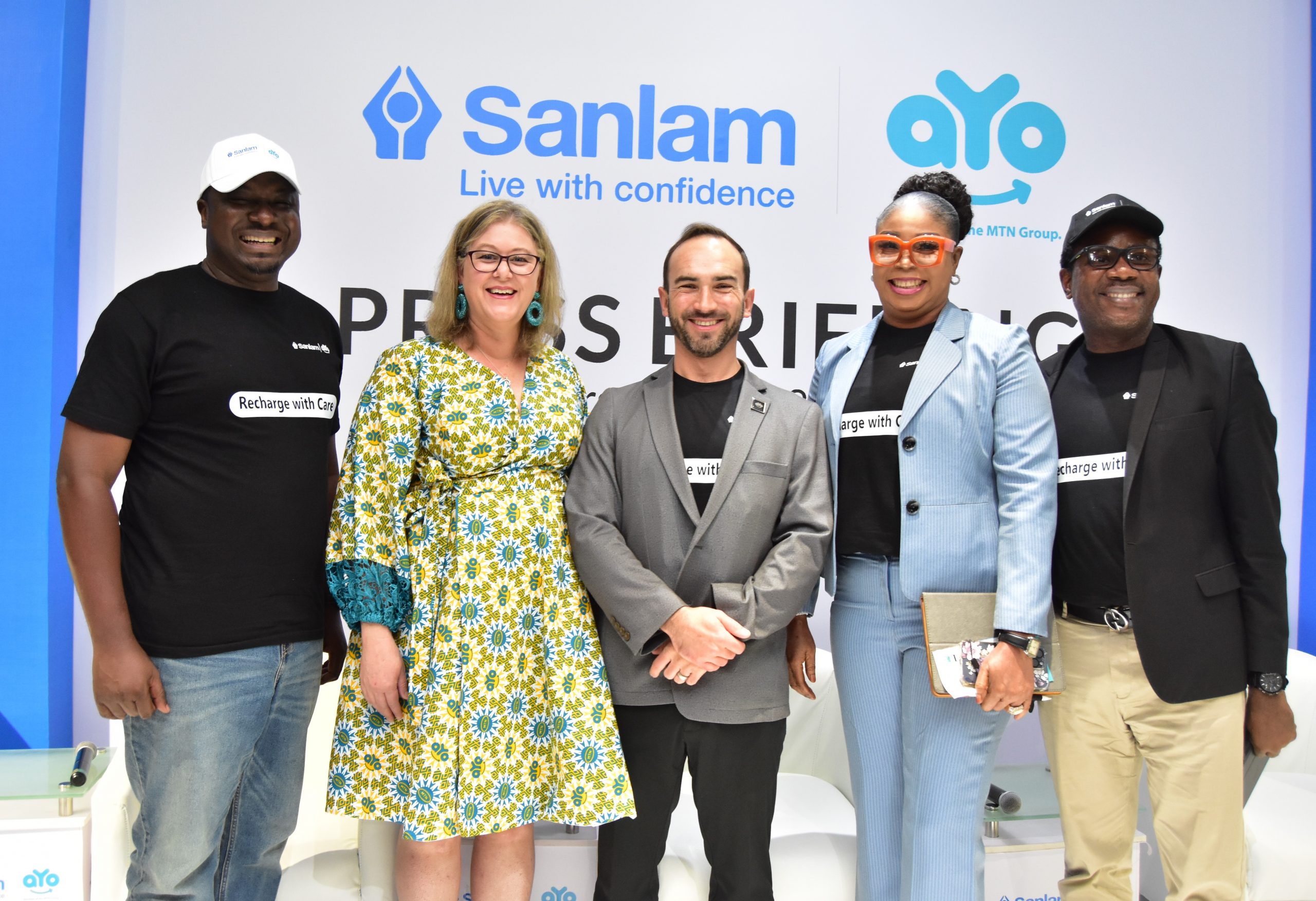

L-R: Country Manager, aYo Nigeria, Kayode Odetola; Group Chief Financial Officer, aYo Holdco, Yvonne Bredenhann; Group Chief Executive Officer, aYo Holdco, Marius Botha; Head, Corporate Distribution, Sanlam General Insurance, Shola Osho, and Managing Director/Chief Executive Officer, Sanlam Life Insurance, Tunde Mimiko, during the press briefing to launch microinsurance product ‘Recharge with Care’ by Sanlam and powered by aYo .

Sanlam, Africa’s biggest insurer, has partnered with the continent’s emerging microinsurance fintech, aYo Holdings, to revolutionise insurance in Nigeria in support of Sanlam’s drive to offer local consumers affordable life and hospitalisation cover.

aYo acts as a technology service provider to Sanlam in Nigeria. It will coordinate technical integration for the underwriter of microinsurance products and provide platform services to enable mobile money and third-party payment offerings. This will enable Sanlam to offer easy-to-understand, convenient and affordable products that challenge traditional insurance offerings in the market.

L-R: Group Chief Financial Officer, aYo Holdco, Yvonne Bredenhann; Country Manager, aYo Nigeria, Kayode Odetola; Group Chief Executive Officer, aYo Holdco, Marius Botha; Managing Director/Chief Executive Officer, Sanlam Life Insurance, Tunde Mimiko, and Head, Corporate Distribution, Sanlam General Insurance, Shola Osho, during the press briefing to launch microinsurance product ‘Recharge with Care’ by Sanlam and powered by aYo on Thursday, June 8, 2023, in Lagos.

Kayode Odetola, Chief Executive Officer of aYo Nigeria, said the company aims to drive greater financial inclusion by using technology to make financial services more readily available across the country.

Mr. Odetola said the low insurance penetration rate in Nigeria (less than 1% of GDP) is one of the lowest in Africa. “Most people think insurance is a luxury product, but we want to show that people with all levels of income can get peace of mind at an affordable cost, to help take care of their financial health in the face of unexpected events,” he said.

“From the seamless onboarding process to the ability to track cover in real-time, we aim to change the perception of insurance by dealing with one of the most important challenges, which is trust,” Mr. Odetola added.

At launch, the Sanlam Recharge with Care product will offer up to N300,000 in life cover and up to N6,500 per day in hospitalisation cover that can be purchased using mobile money wallets and other payment options. Customers can sign up using the progressive web app (PWA) www.sanlam.ayo.com.ng, with a USSD option planned for phase 2.

Mr. Odetola said telco-driven financial services products were well suited for Nigeria’s vast underserved population, which is expected to benefit significantly from Sanlam’s affordable life and hospitalisation covers.

Tunde Mimiko, Chief Executive of Sanlam Life Insurance Nigeria Limited, said the aYo partnership reflects Sanlam’s commitment to deepening insurance penetration in Nigeria by providing accessible life insurance products to more people.

“At Sanlam Nigeria, we aim to form partnerships with organisations who understand the local market and share our values and culture. We’re constantly seeking innovative ways of bringing affordable and fit-for-purpose insurance to all Nigerians. With a trusted partner like aYo on board, the possibilities are as endless as they are exciting,” said Mr. Mimiko.

aYo launched in January 2017 in Uganda and has since expanded its operations across Ghana, Zambia, Côte d’Ivoire and Cameroon, through its stakeholder partnerships with MTN and Sanlam.

“Insurance, and the peace of mind it provides, has become more important than ever in today’s fast-paced world, where risks are a part of our daily lives. You never know when you will have to pay to get back on your feet after an accident or an illness. Often, the cost is so large that it goes beyond your immediate financial capacity, and that is where insurance will be most helpful,” Mr Mimiko added.

About Sanlam

Sanlam is a pan-African brand with a rich history and heritage founded in 1918 as a life insurance company. Headquartered in South Africa, the brand has grown to become Africa’s largest non-banking financial services group, with a strong presence in 33 countries on the African continent, including Nigeria, and a niche presence in India, Malaysia, the United Kingdom and Australia. Indeed, Sanlam operates in 8 out of the 10 largest economies in Africa, with over 154,000 employees globally, delivering superior value to customers, shareholders and the broader society.

Sanlam Nigeria, formerly FBNInsurance, comprising Sanlam Life Insurance Nigeria Limited and Sanlam General Limited, is Nigeria’s fastest growing insurance company with multiple awards and recognitions, including 4-time World Finance Life Insurance Company of the year, among others. With a presence in over 66 locations, the brand is easily one of the most retail-driven insurers in Nigeria, boasting a sales force of over 3000 sales champions and strong, user-friendly technological support to ensure on-the-spot policy uptake. For more information on Sanlam Nigeria, visit www.sanlam.com.ng

About aYo

At aYo, we provide fast, convenient, easy-to-use technical solutions for insurance product delivery and engagement directly to a user’s mobile phone.

Since launching in 2017, aYo has facilitated the payment of over $ 2 million in claims through our operations across Uganda, Ghana, Zambia, Côte d’Ivoire and Cameroon.

We help enable financial inclusion in Africa by offering our customers easy ways to get hospital cover, life cover protection and other general insurance offerings. We specialise in insurance solutions for irregular-income earners. Visit www.ayo-holdings.com for more information.