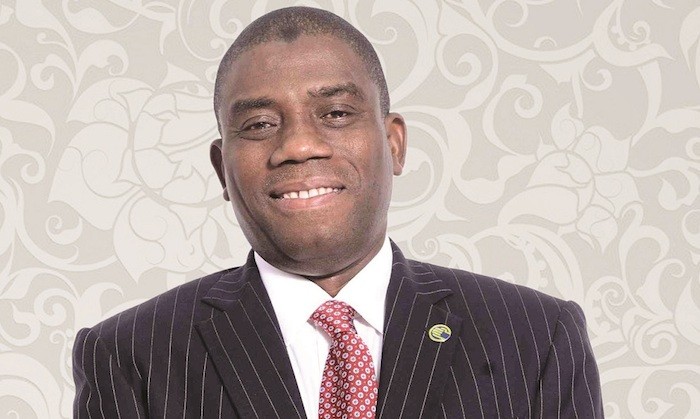

Mr. Ganiyu Musa is the Chairman, Nigerian Insurers Association(NIA) and the group managing director, Cornerstone Insurance Plc. In this interview, he spoke on product development and digitalization in insurance industry, among other sundry issues. Excerpt.

What is your message to NIA members as regards product development?

What has become clear is that product development can no longer occur in silos, with one function creating products for another function to sell. Insurers are determined to make every moving part of their business serve the customer, and what this means in concrete terms is that every division of the business has a contribution to make towards the creation of customer-centric products.

Insurers are only just beginning to tap the opportunities for technology-driven product creation. However, the biggest problem these days is the underlying products are not yet ‘digital ready’, although everybody is talking about digitisation and disruption and are modernising their core systems with huge investments in order to support these new trends, – even new ones.

The biggest risk the insurance industry faces when it comes to innovation is not taking enough risk. True innovation requires experimentation, which most of the time results in failure. Insurance organisations are built to eliminate failure from their culture. Without failure, you can have no innovation. CEOs demand a positive Return on Investment (ROI), they now need to seek out and understand what it means to have a positive Return on Risk (ROR).

You don’t really have to invent new products in my eyes, you just have to make the existing ones easier and more ‘digital native’. Today’s products have been and are still created for non-digitals. And this situation not only makes new customer-facing digital processes complicated, it also makes core replacements and automation more complicated and expensive than necessary.

Most of the innovation in product development will happen where smart connected devices drive new business models based on behavioural data.

I particularly expect improvements in pricing. UBI is a bigger game changer than covering events that are not insured today. In any case, there will be a huge need to understand, measure and manage rational and irrational behaviour.

The cost of customer acquisition is a critical metric for marketing efforts. Lifetime customer value also helps us know how much we should be spending to acquire as well as how we should expand our share of wallet within the products we offer.

How much impact did the #EndSARS protest has on insurance sector in the country?

The first-year anniversary of the protest was a fortnight ago and as an industry that was seriously impacted by the protest, It was an opportunity for us to take stock and flaunt our scorecard in the area of claims payment.

What started as a protest against the State Anti-Robbery Police unit later snowballed into a crisis of unprecedented dimension with resultant loss of lives and properties.

Following huge losses suffered by businesses in the aftermath of the #EndSARS violence, the insurance industry, in line with its role of providing financial intermediation and restoring businesses quickly, moved in to provide the necessary cushion for those that have insurance cover and others who suffered losses to their businesses.

The report shows that insurance companies settled 718 claims on vandalisation; 93 cases on looting; 113 on theft; and 136 on loss of cash, three death claims were paid while claims were paid on other property losses, 99 claims were settled on malicious damage; eight claims on business interruption; 455 claims on burglary attack and 912 claims on fire and burnt site.

We will keep updating our records as they come and when the process is brought to conclusion, we will inform Nigerians about it.

Let me assure you that the insurance industry, in line with its role of providing financial intermediation and restoring businesses, will continue to provide the necessary cushion for those that have insurance cover and others who suffered losses to their businesses.

The insurance industry recently made President Muhammadu Buhari its grand patron. How would this impact insurance business?

Conferring the title of Grand Patron on President Muhammadu Buhari is a good and welcome development which the industry will continue to cherish for a long time to come.

Having the President of the Federal Republic of Nigeria is no mean feat and it attests to the highest level of recognition and approval or endorsement as the case may be.

I believe same will have a positive impact on insurance business as it will: encourage more government patronage and recognition; strengthen regulatory and capital requirements to ensure solvency and sustainability; introduce reforms that will help deepen insurance penetration as well as its very crucial to building consumer trust and public awareness, even as it will challenge the operators to act more ethically among others.

What steps are you taking to ensure Insurers sustain the current momentum brought by the just concluded AIO conference?

Several initiatives introduced by the industry and the Regulator (NAICOM) are ongoing and same will be further strengthened to sustain the current momentum brought by the conference.

These initiatives include: Developments Policy implications; a stronger and more cohesive policy and regulatory response; Capital adequacy and solvency for successful operation of insurance businesses; Supervisory cooperation; Cross-sectoral issues; Reporting – timeliness and relevance; Risk-based supervision and effective tools; Reinsurance supervision and Mechanism for ensuring that standards and guidelines are fully implemented.

The president and his vice have challenged the insurance industry. What will your administration do to meet and surpass expectations from government and the public?

The insurance sector makes an important contribution to the economic development and welfare of a nation by enabling risk transformation. In this way, the insurance sector supports investment, innovation and economic growth, thereby, ensuring a healthy and well-functioning insurance sector.

Insurance transforms accumulated capital into productive investments, mitigates losses, promotes financial stability and trade and commerce resulting in sustainable economic growth and development.

Insurance Provides Safety and Security to Individuals and Businesses: Insurance provides an ideal risk mitigation mechanism against events that can potentially cause financial distress to individuals and businesses.

Insurance generates Long-term Financial Resources. The sector generates funds by way of premium from millions of policyholders. Due to the long-term nature of these funds, they are invested in building long-term infrastructure assets (such as roads, ports, power plants, dams, and so on.) that are significant to nation-building and employment opportunities are also created as a result.

Equally, insurance provides support to families during medical emergencies. The well-being of family is important, and health of family members is the biggest concern for most. From elderly parents to newborn children, medication and hospitalisation play an important role in ensuring well-being of families.

Rising cost of medical treatment and soaring cost of over the-counter drugs are enough to deplete an individual’s savings. Anyone can fall victim to critical illnesses (such as heart attack, stroke, cancer, and so on) unexpectedly.

Medical insurance is a policy that protects individuals financially against different types of health risks and with a Health Insurance policy, an insured can get financial support in case of medical emergency.

Insurance facilitates moving of risk of loss from the insured to the insurer. The basic principle of insurance is to spread risk among many people. Whenever a loss occurs, it is compensated out of corpus of funds collected from the numerous policyholders.

What is your perception about the just concluded AIO conference?

There are many things to learn from the conference that will help to deepen insurance penetration and growth the market.

First, the conference was an opportunity for manpower development for participants via learnings from paper presenters.

It also afforded regulators across the continent the opportunity to review the regulatory frameworks across different regions and take some learnings therefrom.

It was a marketing opportunity for companies and brands and also an opportunity for peer review and standardise of processes.

Additionally, it provided ample opportunity for foreign delegates to experience the warmth, hospitality, splendour, and rich culture of our country thus changing some negative perceptions about Nigeria.