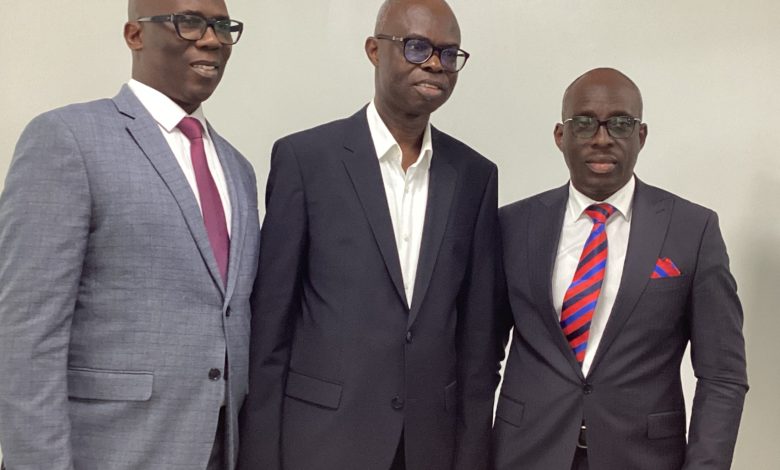

L-R: Mr. Chinedu Onyilimba, Head Corporate Communications and Company Secretary ; Dr. Ben Ujoatuonu, Managing Director/Chief Executive Officer, both from Universal Insurance; and Mr. Tunji Oyebayo, Deputy General Manager, Business Development, Universal Insurance Plc at the NAIPE’s Annual General Meeting (AGM) July 6, 2023 in Lagos.

BY NKECHI NAECHE-ESEZOBOR–Universal Insurance Plc, one of the fastest growing insurance companies in the country, said it has built capacity over the years through a robust and well-structured reinsurance programme.

Managing Director and Chief Executive Officer of the Company, Dr. Ben Ujoatuonu, who disclosed this at the annual general meeting of Nigerian Association of Insurance and Pension Editors (NAIPE) in Lagos, noted that the Company has capacity to carry diverse risks from the insuring public.

Dr. Ujoatuonu further disclosed that the Company has garnered positive recognition in the international reinsurance market. “Since I came on Board as Managing Director of Universal Insurance, we have been able to arrange very robust and well-structured reinsurance programme. He said. “I am a technical person and I understand the trajectory of the business. That has helped us to build capacity over the years”.

“We don’t play with our reinsurance. Our reinsurance broker once said to me, ‘in the international market, you are the only person that doesn’t waste time in paying his reinsurance premium’.

Dr. Ujoatuonu revealed that he is very passionate about having reinsurance cover for the Company’s businesses. I don’t play with it, because you can take a risk today and go to bed and anything can happen the next day. So, we have a well arranged and structured reinsurance programme where we can easily fall back to, and over the years we have also built retention to enable us carry diverse risks from the insuring public.”

He noted that the Company has been working round the clock to build strong units and departments that can deliver value to customers.

“We took time to set up some strong units and departments in our Company and I must tell you that the efforts we put in over time, have started yielding results, and that is what we are seeing now. It did not just come out overnight. We have been working underground in the last six years in developing some areas of our units and that has yielded a whole lot of results.”

The Universal MD explained that the Company takes the issue of insurance awareness creation seriously and is in the forefront of creating awareness on insurance round the country.

According to him, “Insurance awareness is a continuous issue and it is also a very serious issue in our industry. We have embraced opportunities beyond our digital operations and presence in social media. We are also trying to have physical presence as much as possible in areas that we operate.

“In creating awareness, we also seek to support some ideas such as the Chartered Insurance Institute of Nigeria (CIIN) programme of reaching out to people such as the secondary schools reach-out programme and all the rest of it. We participate in the CIIN programmes. And beyond that also, we get to talk to students in some schools.

“Also during NYSC camp, we also have presence there talking about insurance. We are not expecting to get any business in terms of naira and kobo, but to create awareness. The issue is that there are situations where graduates of Nigerian universities don’t even know anything about insurance. We have programmes like that from time to time and we collaborate with other arms of the industry to create the needed awareness.

He said that the aim is not just to create awareness about insurance but to get people to know Universal Insurance and what they are doing.