- Home

- Business

- News

- Tourism / Travels

- Entertainment

- Regulators

- More

- Businesstoday Conference/Awards

- Business Today Magazine

Latest News

Please Subscribe

subribe to get the latest news delivered to you free

ECOWAS Announces State of Emergency Over Rising Coup Attempts

December 9, 2025Cornerstone Insurance Wins Big, Takes Home Two Top Tech Awards

December 9, 2025Nigerian Army Strengthens Ties With National Assembly To Boost Border Security

The Nigerian Army has reiterated its commitment to strengthening partnerships with the National Assembly to enhance national security, particularly in border areas. The...

ByBusinessTodayNGDecember 9, 2025Nigerian Army Strengthens Ties With National Assembly To Boost Border Security

The Nigerian Army has reiterated its commitment to strengthening partnerships with the National Assembly to enhance national security, particularly in border areas. The...

ByBusinessTodayNGDecember 9, 2025Technical Issue Forces NAF C-130 to Land in Burkina Faso, Mission To Resume Soon

BY SUNDAY SAMUEL-The Nigerian Air Force (NAF), on Tuesday confirmed that one of its C-130 transport aircraft made a precautionary landing in Bobo-Dioulasso,...

ByBusinessTodayNGDecember 9, 2025ECOWAS Announces State of Emergency Over Rising Coup Attempts

The Economic Community of West African States (ECOWAS) has announced a regional state of emergency in response to the growing wave of military...

ByBusinessTodayNGDecember 9, 2025NNPC E&P Sets New Production Benchmark With 355,000bpd Milestone

BY NKECHI-NAECHE-ESEZOBOR—NNPC E&P Limited (NEPL), on Tuesday said it has achieved a record production level of 355,000 barrels of oil per day, its...

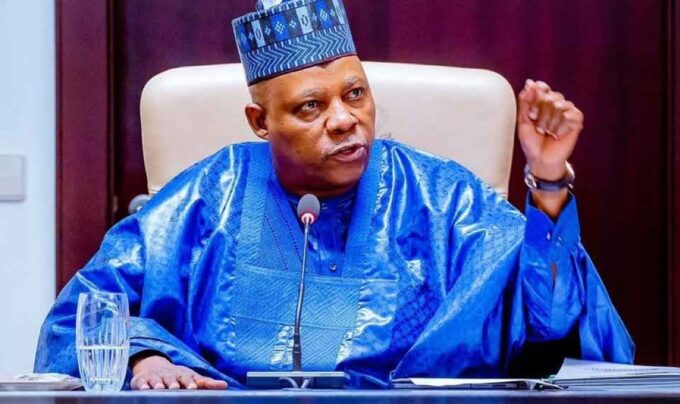

December 9, 2025VP Shettima Reaffirms Nigeria’s Commitment To Regional Stability, Peace

Vice President Kashim Shettima yesterday witnessed the inauguration and swearing-in ceremony of President Alassane Ouattara for another term in office as President of...

December 9, 2025ECOWAS Takes Swift Action, Sends Troops To Benin After Coup Attempt

The Economic Community of West African States (ECOWAS) has ordered the immediate deployment of its Standby Force in Benin following Sunday morning’s aborted...

December 8, 2025GPT Security Risks: NITDA Flags Seven Critical Weaknesses in OpenAI Systems

The National Information Technology Development Agency (NITDA) has issued a security advisory warning Nigerians about newly discovered vulnerabilities in OpenAI’s GPT-4.0 and GPT-5...

December 8, 2025Cornerstone Insurance Wins Big, Takes Home Two Top Tech Awards

Ikekhua, Mimiko, Two Others Join Governing Council Of NIA

Seinde Fadeni Resigns From Board of Consolidated Hallmark Holdings Plc

GCR Upgrades NEM Insurance to AA+ as Strong Capitalisation Boosts Profile

FSL Insurance Brokers Unveils “FSL Insure” App to Revolutionize Digital Insurance In Nigeria

National Assembly Queries NNPCL, Sets Dec. 15 Deadline For Accountability Report

The House of Representatives Committee on Public Account has scheduled Dec. 15 for Nigerian National Petroleum Company Ltd. (NNPCL) to appear and account...

ByBusinessTodayNGDecember 8, 2025$35m NCDMB Project: No Report to Show That the Project Has Been Executed… Witness

The trial of Akindele Akintoye, Platforms Capital Investment Partners Limited and Duport Midstream Company Limited continued on Tuesday, December 2, 2025, before Justice...

ByBusinessTodayNGDecember 3, 2025Shell and Equinor complete formation of Adura, to be the UK’s largest independent North Sea producer

Shell U.K. Limited, a subsidiary of Shell plc and Equinor UK Limited, a subsidiary of Equinor ASA have completed a deal to combine...

ByBusinessTodayNGDecember 2, 2025FG Sets Up Inter-Ministerial Committee to Deliver Reliable Power to Health Facilities Nationwide

The Federal Government inaugurated an Inter-Ministerial Steering Committee (IMSC) for the Nigeria Power-for-Health Initiative (NPHI), a major step towards ending chronic power shortages...

ByBusinessTodayNGDecember 1, 2025Dangote Refinery Targets 1.5bn Litres Of PMS Monthly To Stabilise Fuel Supply

BY OUR REPORTER—Dangote Petroleum Refinery has announced plans to supply one billion five hundred million litres of Premium Motor Spirit (PMS) monthly to...

ByBusinessTodayNGNovember 30, 2025NNPC/Heirs Energies Drives Domestic Gas Growth with 135m Per Day Production Increase

In what is considered as a breakthrough in Nigerian oil sector, The NNPC/Heirs Energies OML 17 Joint Venture (JV) disclosed that it has...

ByBusinessTodayNGNovember 26, 2025

FMDQ Urges Stakeholders to Use Celebrities To Drive Investment Reforms

BY NECHI NAECHE-ESEZOBOR—The Senior Vice President of Government Affairs at FMDQ Group, Emmanuel Etaderhi, has urged regulators and market operators to deploy pop...

ByBusinessTodayNGDecember 9, 2025CSCS Launches T+2 Settlement Cycle, Marking Major Leap in Nigeria’s Capital Market Efficiency

BY NKECHI NAECHE-ESEZOBOR—The Central Securities Clearing System Plc (CSCS), Nigeria’s premier capital market infrastructure, is pleased to announce the official go-live of the...

ByBusinessTodayNGNovember 28, 2025Nigeria’s FATF Milestone: SEC Demands Sustained Compliance From Market Players

The Director General of the Securities and Exchange Commission (SEC), Dr. Emomotimi Agama, has urged financial sector stakeholders to strengthen and sustain a...

ByBusinessTodayNGNovember 24, 2025Boko Haram Terrorists Abduct 12 Female Farmers in Borno

The Borno State police Command on Sunday confirmed that Suspected Boko Haram terrorists have abducted at 12 women in Mussa district, Askira-Uba Local...

ByBusinessTodayNGNovember 23, 2025Breaking :Terrorists Invade Niger Catholic School , Abduct 52 Students

Barely five days after Government Girls Comprehensive Senior Secondary School(GGCSS), 52 students of St. Mary’s Papiri Private Catholic Secondary School, Papiri, in Agwara...

ByBusinessTodayNGNovember 21, 2025VFD Redeems ₦12.8b CP, Reinforcing Strong Liquidity And Credibility

NKECHI NAECHE-ESEZOBOR—VFD Group PLC the fast-growing Principal Investment firm, has announced the successful, timely redemption of its ₦12.83 Billion Series 5 Commercial Paper...

ByBusinessTodayNGNovember 19, 2025

Access Bank Botswana Earns Three Global Recognitions for Innovation and Excellence

Access Bank Botswana, a subsidiary of Access Bank Group, has achieved global recognition by securing three prestigious international awards that celebrate its innovation,...

ByMichael EsezoborDecember 8, 2025UBA Group Dominates 2025 Banker Awards, Emerges Africa’s Bank of the Year For Third Time In Five Years

….Wins Best Bank In Nine Out Of 20 African Subsidiaries Africa’s Global Bank, United Bank for Africa (UBA) Plc, has once again, reaffirmed...

ByBusinessTodayNGDecember 8, 2025Central Bank Relaxes Cash Limits Nationwide To Boost Liquidity

BY NKECHI NAECHE-ESEZOBOR—The Central Bank of Nigeria (CBN) on Wednesday announced a major relaxation of its cash withdrawal and deposit regulations, effective January...

ByBusinessTodayNGDecember 3, 2025

Nigerian Army Strengthens Ties With National Assembly To Boost Border Security

The Nigerian Army has reiterated its commitment to strengthening partnerships with the National Assembly to enhance national security, particularly in border areas. The...

ByBusinessTodayNGDecember 9, 2025Technical Issue Forces NAF C-130 to Land in Burkina Faso, Mission To Resume Soon

BY SUNDAY SAMUEL-The Nigerian Air Force (NAF), on Tuesday confirmed that one of its C-130 transport aircraft made a precautionary landing in Bobo-Dioulasso,...

ByBusinessTodayNGDecember 9, 2025ECOWAS Announces State of Emergency Over Rising Coup Attempts

The Economic Community of West African States (ECOWAS) has announced a regional state of emergency in response to the growing wave of military...

ByBusinessTodayNGDecember 9, 2025NNPC E&P Sets New Production Benchmark With 355,000bpd Milestone

BY NKECHI-NAECHE-ESEZOBOR—NNPC E&P Limited (NEPL), on Tuesday said it has achieved a record production level of 355,000 barrels of oil per day, its...

ByBusinessTodayNGDecember 9, 2025VP Shettima Reaffirms Nigeria’s Commitment To Regional Stability, Peace

Vice President Kashim Shettima yesterday witnessed the inauguration and swearing-in ceremony of President Alassane Ouattara for another term in office as President of...

ByBusinessTodayNGDecember 9, 2025ECOWAS Takes Swift Action, Sends Troops To Benin After Coup Attempt

The Economic Community of West African States (ECOWAS) has ordered the immediate deployment of its Standby Force in Benin following Sunday morning’s aborted...

ByBusinessTodayNGDecember 8, 2025GPT Security Risks: NITDA Flags Seven Critical Weaknesses in OpenAI Systems

The National Information Technology Development Agency (NITDA) has issued a security advisory warning Nigerians about newly discovered vulnerabilities in OpenAI’s GPT-4.0 and GPT-5...

ByBusinessTodayNGDecember 8, 2025Niger State Receives 100 Rescued Schoolchildren Kidnapped

BY JOE ADEBOWALE—The Niger State Government has received 100 schoolchildren who were abducted last month from St. Mary’s Catholic Primary and Secondary School,...

ByBusinessTodayNGDecember 8, 2025